Wilson-Gorman Tariff Act

Encyclopedia

Tariff in American history

Tariffs in United States history have played different roles in trade policy, political debates and the nation's economic history. Tariffs were the largest source of federal revenue from the 1790s to the eve of World War I, until it was surpassed by income taxes. Tariffs are taxes on imports and...

rates from the numbers set in the 1890 McKinley tariff

McKinley Tariff

The Tariff Act of 1890, commonly called the McKinley Tariff, was an act framed by Representative William McKinley that became law on October 1, 1890. The tariff raised the average duty on imports to almost fifty percent, an act designed to protect domestic industries from foreign competition...

and imposed a 2% income tax. It is named for William L. Wilson

William Lyne Wilson

William Lyne Wilson was a Bourbon Democrat politician and lawyer from West Virginia.-Biography:Born in Charles Town, Virginia , Wilson attended Charles Town Academy, graduated from Columbian College in 1860 and subsequently studied at the University of Virginia...

, Representative from West Virginia, chair of the U.S. House Ways and Means Committee, and Senator Arthur P. Gorman of Maryland

Maryland

Maryland is a U.S. state located in the Mid Atlantic region of the United States, bordering Virginia, West Virginia, and the District of Columbia to its south and west; Pennsylvania to its north; and Delaware to its east...

, both Democrats

History of the United States Democratic Party

The history of the Democratic Party of the United States is an account of the oldest political party in the United States and arguably the oldest democratic party in the world....

.

Supported by the Democrat

History of the United States Democratic Party

The history of the Democratic Party of the United States is an account of the oldest political party in the United States and arguably the oldest democratic party in the world....

s, this attempt at tariff reform was important because it imposed the first peacetime income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

(2% on income over $4,000 or $88,100 in 2010 dollars, which meant fewer than 10% of households would pay any). The purpose of the income tax was to make up for revenue that would be lost by tariff reductions. By coincidence, $4,000 ($88,100 in 2010 dollars) would be the exemption for married couples when the Revenue Act of (October) 1913 was signed into law by President Woodrow Wilson, as a result of the ratification of the 16th Amendment

Sixteenth Amendment to the United States Constitution

The Sixteenth Amendment to the United States Constitution allows the Congress to levy an income tax without apportioning it among the states or basing it on Census results...

to the U.S. Constitution in February 1913.

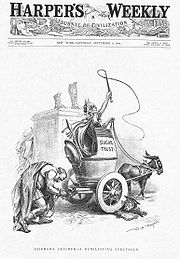

The bill introduced by Wilson and passed by the House significantly lowered tariff rates, in accordance with Democratic platform promises, and dropped the tariff to zero on iron ore, coal, lumber and wool, which angered American producers. With Senator Gorman operating behind the scenes, protectionists in the Senate added more than 600 amendments that nullified most of the reforms and raised rates again. The "Sugar Trust" in particular made changes that favored itself at the expense of the consumer.

President Grover Cleveland

Grover Cleveland

Stephen Grover Cleveland was the 22nd and 24th president of the United States. Cleveland is the only president to serve two non-consecutive terms and therefore is the only individual to be counted twice in the numbering of the presidents...

, who had campaigned on lowering the tariff and supported Wilson's version of the bill, was devastated that his program had been ruined. He denounced the revised measure as a disgraceful product of "party perfidy and party dishonor," but still allowed it to become law without his signature, believing that it was better than nothing and was at the least an improvement over the McKinley tariff.

The Wilson-Gorman Tariff attracted much opposition in West Texas

West Texas

West Texas is a vernacular term applied to a region in the southwestern quadrant of the United States that primarily encompasses the arid and semi-arid lands in the western portion of the state of Texas....

, where sheepraisers opposed the measure. A Republican, George H. Noonan

George H. Noonan

George Henry Noonan was a U.S. Representative from Texas. He was the first Republican congressman from Texas not elected during Reconstruction....

, was elected to Congress from the district stretching from San Angelo

San Angelo, Texas

San Angelo is a city in the state of Texas. Located in West Central Texas it is the county seat of Tom Green County. As of 2010 according to the United States Census Bureau, the city had a total population of 93,200...

to San Antonio

San Antonio, Texas

San Antonio is the seventh-largest city in the United States of America and the second-largest city within the state of Texas, with a population of 1.33 million. Located in the American Southwest and the south–central part of Texas, the city serves as the seat of Bexar County. In 2011,...

but only for a single term. Among Noonan's backers was a former slave, George B. Jackson

George B. Jackson

George B. Jackson was a businessman, sheep rancher, and Republican politician from San Angelo who was believed to have been the wealthiest African American in Texas during the second half of the 19th century.-Background:...

, a businessman in San Angelo often called "the wealthiest black man in Texas" in the late 19th century.

Income Tax Amendment

The New York Times reported that many Democrats in the East, "prefer to take the income tax, odious as it is, and unpopular as it is bound to be with their constituents," than to defeat the Wilson tariff bill. Democratic Representative Johnson of Ohio supported the income tax as the lesser of two evils:"he was for an income tax as against a tariff tax; but he believed, that it was un-Democratic, inquisitorial, and wrong in principle."

Legacy

The income tax provision was struck down in 1895 by the U.S. Supreme CourtSupreme Court of the United States

The Supreme Court of the United States is the highest court in the United States. It has ultimate appellate jurisdiction over all state and federal courts, and original jurisdiction over a small range of cases...

case Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Company, , aff'd on reh'g, , with a ruling of 5–4, was a landmark case in which the Supreme Court of the United States ruled that the unapportioned income taxes on interest, dividends and rents imposed by the Income Tax Act of 1894 were, in effect, direct taxes, and...

, . In 1913, the 16th Amendment

Sixteenth Amendment to the United States Constitution

The Sixteenth Amendment to the United States Constitution allows the Congress to levy an income tax without apportioning it among the states or basing it on Census results...

permitted a federal income tax.

The tariff provisions of Wilson-Gorman were superseded by the Dingley Tariff

Dingley Act

The Dingley Act of 1897 , introduced by U.S. Representative Nelson Dingley, Jr. of Maine, raised tariffs in United States to counteract the Wilson–Gorman Tariff Act of 1894, which had lowered rates....

of 1897.