Structure of the Federal Reserve System

Encyclopedia

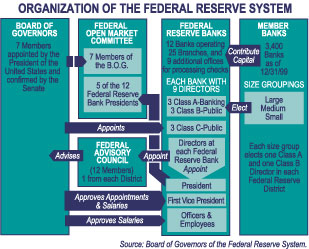

The Federal Reserve System is composed of five parts:

According to the board of governors of the Federal Reserve, "It is not 'owned' by anyone and is 'not a private, profit-making institution'. Instead, it is an independent entity within the government, having both public purposes and private aspects." The U.S. Government does not own shares in the Federal Reserve System or its component banks, but does receive all of the system's annual profits after a statutory dividend

of 6% on their capital investment is paid to member banks and a capital account surplus is maintained. The government also exercises some control over the Federal Reserve by appointing and setting the salaries of the system's highest-level employees. The Federal Reserve transferred $79 billion to the U.S. Treasury in 2010.

The division of the responsibilities of a central bank into several separate and independent parts, some private and some public, results in a structure that is considered unique among central banks. It is also unusual in that an entity (the U.S. Department of the Treasury) outside of the central bank creates the currency

used.

The Federal Reserve System is an independent government institution that has private aspects. The System is not a private organization and does not operate for the purpose of making a profit. The stocks of the regional federal reserve banks are owned by the banks operating within that region and which are part of the system. The System derives its authority and public purpose from the Federal Reserve Act

The Federal Reserve System is an independent government institution that has private aspects. The System is not a private organization and does not operate for the purpose of making a profit. The stocks of the regional federal reserve banks are owned by the banks operating within that region and which are part of the system. The System derives its authority and public purpose from the Federal Reserve Act

passed by Congress in 1913. As an independent institution, the Federal Reserve System has the authority to act on its own without prior approval from Congress or the President. The members of its Board of Governors are appointed for long, staggered terms, limiting the influence of day-to-day political considerations. The Federal Reserve System's unique structure also provides internal checks and balances, ensuring that its decisions and operations are not dominated by any one part of the system. It also generates revenue independently without need for Congressional funding. Congressional oversight and statutes, which can alter the Fed's responsibilities and control, allow the government to keep the Federal Reserve System in check. Since the System was designed to be independent while also remaining within the government of the United States, it is often said to be "independent within the government".

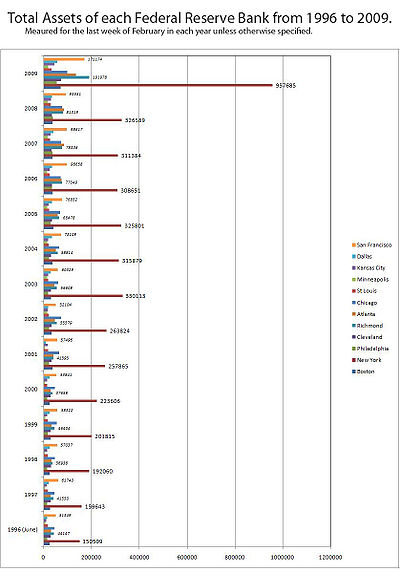

The twelve Federal Reserve banks provide the financial means to operate the Federal Reserve System. Each reserve bank is organized much like a private corporation so that it can provide the necessary revenue to cover operational expenses and implement the demands of the board. A member bank is a privately owned bank that must buy an amount equal to 3% of its combined capital and surplus of stock in the Reserve Bank within its region of the Federal Reserve System. This stock "may not be sold, traded, or pledged as security for a loan" and all member banks receive a 6% annual dividend. No stock in any Federal Reserve Bank has ever been sold to the public, to foreigners, or to any non-bank U.S. firm. These member banks must maintain fractional reserves

either as vault currency or on account at its Reserve Bank. As of October 2008, the Federal Reserve has paid interest to banks' holdings in Reserve Banks' accounts. The dividends paid by the Federal Reserve Banks to member banks are considered partial compensation for the lack of interest paid on the required reserves. All profit after expenses is returned to the U.S. Treasury or contributed to the surplus capital of the Federal Reserve Banks (and since shares in ownership of the Federal Reserve Banks are redeemable only at par, the nominal "owners" do not benefit from this surplus capital); the Federal Reserve System contributed $79 billion to the U.S. Treasury in 2010.

Whole

Whole

Board of Governors

Federal Open Market Committee

Federal Reserve Banks;

Member banks

Advisory Committees

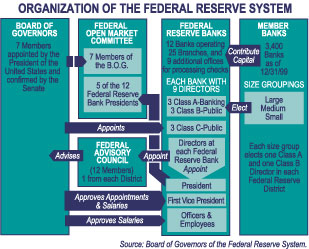

The seven-member Board of Governors is the main governing body of the Federal Reserve System. It is charged with overseeing the 12 District Reserve Banks and with helping implement national monetary policy. Governors are appointed by the President of the United States

The seven-member Board of Governors is the main governing body of the Federal Reserve System. It is charged with overseeing the 12 District Reserve Banks and with helping implement national monetary policy. Governors are appointed by the President of the United States

and confirmed by the Senate

for staggered, 14-year terms. By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country", and as stipulated in the Banking Act of 1935, the Chairman and Vice Chairman of the Board are two of seven members of the Board of Governors who are appointed by the President

from among the sitting Governors. As an independent federal government agency

, the Board of Governors does not receive funding from Congress, and the terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president, he or she functions mostly independently. The Board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives. It also supervises and regulates the operations of the Federal Reserve Banks, and the U.S. banking system in general.

Membership is by statute limited in term, and a member that has served for a full 14 year term is not eligible for reappointment. There are numerous occasions where an individual was appointed to serve the remainder of another member's uncompleted term, and has been reappointed to serve a full 14-year term. Since "upon the expiration of their terms of office, members of the Board shall continue to serve until their successors are appointed and have qualified", it is possible for a member to serve for significantly longer than a full term of 14 years. The law provides for the removal of a member of the Board by the President "for cause".

The current members of the Board of Governors are as follows:

The Federal Open Market Committee

The Federal Open Market Committee

(FOMC) created under comprises the seven members of the board of governors and five representatives selected from the regional Federal Reserve Banks. The FOMC is charged under law with overseeing open market operations, the principal tool of national monetary policy. These operations affect the amount of Federal Reserve balances available to depository institutions, thereby influencing overall monetary and credit conditions. The FOMC also directs operations undertaken by the Federal Reserve in foreign exchange markets. The representative from the Second District, New York, is a permanent member, while the rest of the banks rotate at two- and three-year intervals. All the presidents participate in FOMC discussions, contributing to the committee's assessment of the economy and of policy options, but only the five presidents who are committee members vote on policy decisions. The FOMC, under law, determines its own internal organization and by tradition elects the Chairman of the Board of Governors as its chairman and the president of the Federal Reserve Bank of New York as its vice chairman. Formal meetings typically are held eight times each year in Washington, D.C. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion. The FOMC generally meets eight times a year in Telephone consultations and other meetings are held when needed.

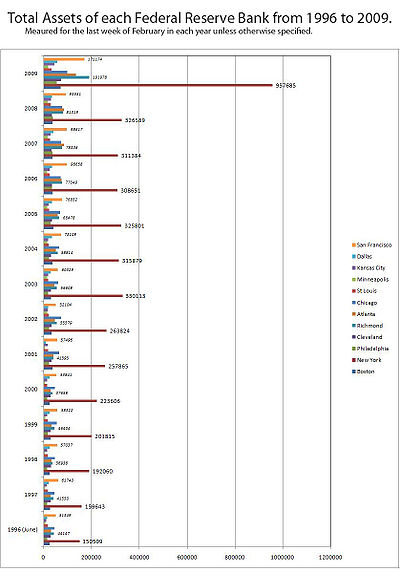

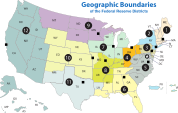

There are 12 regional Federal Reserve Banks (not to be confused with the "member banks") with 25 branches, which serve as the operating arms of the system. Each Federal Reserve Bank is subject to oversight by the Board of Governors. Each Federal Reserve Bank has a board of directors, whose members work closely with their Reserve Bank president to provide grassroots economic information and input on management and monetary policy decisions. These boards are drawn from the general public and the banking community and oversee the activities of the organization. They also appoint the presidents of the Reserve Banks, subject to the approval of the Board of Governors. Reserve Bank boards consist of nine members: six serving as representatives of nonbanking enterprises and the public (nonbankers) and three as representatives of banking. Each Federal Reserve branch office has its own board of directors, composed of three to seven members, that provides vital information concerning the regional economy.

There are 12 regional Federal Reserve Banks (not to be confused with the "member banks") with 25 branches, which serve as the operating arms of the system. Each Federal Reserve Bank is subject to oversight by the Board of Governors. Each Federal Reserve Bank has a board of directors, whose members work closely with their Reserve Bank president to provide grassroots economic information and input on management and monetary policy decisions. These boards are drawn from the general public and the banking community and oversee the activities of the organization. They also appoint the presidents of the Reserve Banks, subject to the approval of the Board of Governors. Reserve Bank boards consist of nine members: six serving as representatives of nonbanking enterprises and the public (nonbankers) and three as representatives of banking. Each Federal Reserve branch office has its own board of directors, composed of three to seven members, that provides vital information concerning the regional economy.

The Reserve Banks opened for business on November 16, 1914. Federal Reserve Note

The Reserve Banks opened for business on November 16, 1914. Federal Reserve Note

s were created as part of the legislation to provide a supply of currency. The notes were to be issued to the Reserve Banks for subsequent transmittal to banking institutions. The various components of the Federal Reserve System have differing legal statuses.

stated that: "The Reserve Banks are not federal instrumentalities for purposes of the FTCA [the Federal Tort Claims Act

], but are independent, privately owned and locally controlled corporations." The opinion went on to say, however, that: "The Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another relevant decision is Scott v. Federal Reserve Bank of Kansas City, in which the distinction is made between Federal Reserve Banks, which are federally-created instrumentalities, and the Board of Governors, which is a federal agency.

A list of all of the members of the Reserve Banks' boards of directors is published by the Federal Reserve.

The terms of all the presidents of the twelve District Banks run concurrently, ending on the last day of February every five years. The appointment of a President who takes office after a term has begun ends upon the completion of that term. A president of a Reserve Bank may be reappointed after serving a full term or an incomplete term.

Reserve Bank presidents are subject to mandatory retirement upon becoming 65 years of age. However, presidents initially appointed after age 55 can, at the option of the board of directors, be permitted to serve until attaining ten years of service in the office or age 70, whichever comes first.

or securities broker-dealer

that may trade directly with the Federal Reserve System of the United States

. They are required to make bids or offers when the Fed conducts open market operations, provide information to the Fed's open market trading desk, and to participate actively in U.S. Treasury

securities auctions. They consult with both the U.S. Treasury and the Fed about funding the budget deficit and implementing monetary policy

. Many former employees of primary dealers work at the Treasury, because of their expertise in the government debt markets, though the Fed avoids a similar revolving door

policy.

Between them, these dealers purchase the vast majority of the U.S. Treasury securities (T-bills, T-notes, and T-bonds) sold at auction, and resell them to the public. Their activities extend well beyond the Treasury market, for example, according to the Wall Street Journal Europe (2/9/06 p. 20), all of the top ten dealers in the foreign exchange market

are also primary dealers, and between them account for almost 73% of forex trading volume. Arguably, this group's members are the most influential and powerful non-governmental institutions in world financial markets.

The primary dealers form a worldwide network that distributes new U.S. government debt. For example, Daiwa Securities and Mizuho Securities distribute the debt to Japanese buyers. BNP Paribas, Barclays, Deutsche Bank, and RBS Greenwich Capital

(a division of the Royal Bank of Scotland

) distribute the debt to European buyers. Goldman Sachs, and Citigroup account for many American buyers. Nevertheless, most of these firms compete internationally and in all major financial centers.

the list includes:

The Primary Dealers List is available at the Federal Reserve Bank of New York website. Changes are available at Changes to Primary Dealers List.

Five notable changes to the list have occurred in 2008. Countrywide Securities Corporation

was removed on July 15 due to its acquisition by Bank of America. Lehman Brothers Inc.

was removed on September 22 due to bankruptcy. Bear Stearns

& Co. Inc. was removed from the list on October 1 due to its acquisition by J.P. Morgan Chase. On February 11, 2009, Merrill Lynch Government Securities Inc.

was removed from the list due to its acquisition by Bank of America.

All nationally chartered banks hold stock in one of the Federal Reserve banks. State-chartered banks may choose to be members (and hold stock in a regional Federal Reserve bank), upon meeting certain standards.

Holding stock in a Federal Reserve bank is not, however, like owning publicly traded stock. The stock cannot be sold or traded. Member banks receive a fixed, 6% dividend annually on their stock, and they do not directly control the applicable Federal Reserve bank as a result of owning this stock. They do, however, elect six of the nine members of Reserve banks' boards of directors. Federal statute provides (in part): "Every national bank in any State shall, upon commencing business or within ninety days after admission into the Union of the State in which it is located, become a member bank of the Federal Reserve System by subscribing and paying for stock in the Federal Reserve bank of its district in accordance with the provisions of this chapter and shall thereupon be an insured bank under the Federal Deposit Insurance Act [. . . .]"

Other banks may elect to become member banks. According to the Federal Reserve Bank of Boston:

For example, as of October 2006 the member banks in New Hampshire included Community Guaranty Savings Bank, The Lancaster National Bank, The Pemigewasset National Bank of Plymouth, and other banks. In California, member banks, as of September 2006, included Bank of America California, National Association, The Bank of New York Trust Company, National Association, Barclays Global Investors, National Association, and many other banks.

Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

(FDIC)-insured banks. national banks (N) and state members (SM) are members of the Federal Reserve System while the rest of the FDIC-insured banks are not members.

Each charter type is defined as follows:

While the OI, SA, and SB categories are not members of the system, they are sometimes treated as if they were members under certain circumstances.

A list of all member banks can be found at the website of the Federal Deposit Insurance Corporation

(FDIC). Most commercial banks in the United States are not members of the Federal Reserve System, but the total value of all the banking assets of member banks is substantially larger than the total value of the banking assets of nonmembers.

Of these advisory committees, perhaps the most important are the committees (one for each Reserve Bank) that advise the Banks on matters of agriculture, small business, and labor. Biannually, the Board solicits the views of each of these committees by mail.

- The presidentially appointed Board of Governors (or Federal Reserve Board), an independent federal government agencyIndependent agencies of the United States governmentIndependent agencies of the United States federal government are those agencies that exist outside of the federal executive departments...

located in Washington, D.C.Washington, D.C.Washington, D.C., formally the District of Columbia and commonly referred to as Washington, "the District", or simply D.C., is the capital of the United States. On July 16, 1790, the United States Congress approved the creation of a permanent national capital as permitted by the U.S. Constitution.... - The Federal Open Market CommitteeFederal Open Market CommitteeThe Federal Open Market Committee , a committee within the Federal Reserve System, is charged under United States law with overseeing the nation's open market operations . It is the Federal Reserve committee that makes key decisions about interest rates and the growth of the United States money...

(FOMC), composed of the seven members of the Federal Reserve Board and five of the twelve Federal Reserve Bank presidents, which oversees open market operations, the principal tool of U.S. monetary policy. - Twelve regional Federal Reserve BankFederal Reserve BankThe twelve Federal Reserve Banks form a major part of the Federal Reserve System, the central banking system of the United States. The twelve federal reserve banks together divide the nation into twelve Federal Reserve Districts, the twelve banking districts created by the Federal Reserve Act of...

s located in major cities throughout the nation, which divide the nation into twelve Federal Reserve districts. The Federal Reserve Banks act as fiscal agents for the U.S. Treasury, and each has its own nine-member board of directors. - Numerous other private U.S. member banks, which own required amounts of non-transferable stock in their regional Federal Reserve Banks.

- Various advisory councils.

According to the board of governors of the Federal Reserve, "It is not 'owned' by anyone and is 'not a private, profit-making institution'. Instead, it is an independent entity within the government, having both public purposes and private aspects." The U.S. Government does not own shares in the Federal Reserve System or its component banks, but does receive all of the system's annual profits after a statutory dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

of 6% on their capital investment is paid to member banks and a capital account surplus is maintained. The government also exercises some control over the Federal Reserve by appointing and setting the salaries of the system's highest-level employees. The Federal Reserve transferred $79 billion to the U.S. Treasury in 2010.

The division of the responsibilities of a central bank into several separate and independent parts, some private and some public, results in a structure that is considered unique among central banks. It is also unusual in that an entity (the U.S. Department of the Treasury) outside of the central bank creates the currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

used.

Independent within government

Federal Reserve Act

The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

passed by Congress in 1913. As an independent institution, the Federal Reserve System has the authority to act on its own without prior approval from Congress or the President. The members of its Board of Governors are appointed for long, staggered terms, limiting the influence of day-to-day political considerations. The Federal Reserve System's unique structure also provides internal checks and balances, ensuring that its decisions and operations are not dominated by any one part of the system. It also generates revenue independently without need for Congressional funding. Congressional oversight and statutes, which can alter the Fed's responsibilities and control, allow the government to keep the Federal Reserve System in check. Since the System was designed to be independent while also remaining within the government of the United States, it is often said to be "independent within the government".

The twelve Federal Reserve banks provide the financial means to operate the Federal Reserve System. Each reserve bank is organized much like a private corporation so that it can provide the necessary revenue to cover operational expenses and implement the demands of the board. A member bank is a privately owned bank that must buy an amount equal to 3% of its combined capital and surplus of stock in the Reserve Bank within its region of the Federal Reserve System. This stock "may not be sold, traded, or pledged as security for a loan" and all member banks receive a 6% annual dividend. No stock in any Federal Reserve Bank has ever been sold to the public, to foreigners, or to any non-bank U.S. firm. These member banks must maintain fractional reserves

Fractional-reserve banking

Fractional-reserve banking is a form of banking where banks maintain reserves that are only a fraction of the customer's deposits. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction of the quantity of deposits as reserves...

either as vault currency or on account at its Reserve Bank. As of October 2008, the Federal Reserve has paid interest to banks' holdings in Reserve Banks' accounts. The dividends paid by the Federal Reserve Banks to member banks are considered partial compensation for the lack of interest paid on the required reserves. All profit after expenses is returned to the U.S. Treasury or contributed to the surplus capital of the Federal Reserve Banks (and since shares in ownership of the Federal Reserve Banks are redeemable only at par, the nominal "owners" do not benefit from this surplus capital); the Federal Reserve System contributed $79 billion to the U.S. Treasury in 2010.

Outline

- The nation's central bank

- A regional structure with 12 districts

- Subject to general Congressional authority and oversight

- Operates on its own earnings

Board of Governors

- Seven members serving staggered 14-year terms

- Appointed by the U.S. President and confirmed by the Senate

- Oversees System operations, makes regulatory decisions, and sets reserve requirements

Federal Open Market Committee

Federal Open Market Committee

The Federal Open Market Committee , a committee within the Federal Reserve System, is charged under United States law with overseeing the nation's open market operations . It is the Federal Reserve committee that makes key decisions about interest rates and the growth of the United States money...

- The System's key monetary policymaking body

- Decisions seek to foster economic growth with price stability by influencing the flow of money and credit

- Composed of the seven members of the Board of Governors and five Reserve Bank presidents, one of whom is the president of the Federal Reserve Bank of New York, the other presidents serve as voting members for one-year terms on a rotating basis.

Federal Reserve Banks;

- 12 regional banks with 25 branches

- Each independently incorporated with a nine member board of directors, with six of them elected by the member banks while the remaining three are designated by the Board of Governors.

- Set discount rate, subject to approval by Board of Governors.

- Monitor economy and financial institutions in their districts and provide financial services to the U.S. government and depository institutions.

Member banks

- Private banks

- Hold stock in their local Federal Reserve Bank

- Elect six of the nine members of Reserve Banks' boards of directors.

Advisory Committees

- Carry out varied responsibilities

Board of Governors

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

and confirmed by the Senate

United States Senate

The United States Senate is the upper house of the bicameral legislature of the United States, and together with the United States House of Representatives comprises the United States Congress. The composition and powers of the Senate are established in Article One of the U.S. Constitution. Each...

for staggered, 14-year terms. By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country", and as stipulated in the Banking Act of 1935, the Chairman and Vice Chairman of the Board are two of seven members of the Board of Governors who are appointed by the President

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

from among the sitting Governors. As an independent federal government agency

Independent agencies of the United States government

Independent agencies of the United States federal government are those agencies that exist outside of the federal executive departments...

, the Board of Governors does not receive funding from Congress, and the terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president, he or she functions mostly independently. The Board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives. It also supervises and regulates the operations of the Federal Reserve Banks, and the U.S. banking system in general.

Membership is by statute limited in term, and a member that has served for a full 14 year term is not eligible for reappointment. There are numerous occasions where an individual was appointed to serve the remainder of another member's uncompleted term, and has been reappointed to serve a full 14-year term. Since "upon the expiration of their terms of office, members of the Board shall continue to serve until their successors are appointed and have qualified", it is possible for a member to serve for significantly longer than a full term of 14 years. The law provides for the removal of a member of the Board by the President "for cause".

The current members of the Board of Governors are as follows:

| Commissioner | Entered office | Term expires |

|---|---|---|

| Ben Bernanke Ben Bernanke Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis.... (Chairman) |

February 1, 2006 | January 31, 2020 January 31, 2014 (as Chairman) |

| Janet Yellen Janet Yellen Janet Louise Yellen is an American economist and professor, who is currently the Vice Chair of the Board of Governors of the Federal Reserve System... (Vice Chairman) |

October 4, 2010 | January 31, 2024 October 4, 2014 (as Vice Chairman) |

| Vacant | —— | |

| Elizabeth A. Duke | August 5, 2008 | January 31, 2012 |

| Daniel Tarullo Daniel Tarullo Daniel Tarullo is a professor of Law at Georgetown University Law Center and a member of the Board of Governors of the United States Federal Reserve Board since January 28th, 2009... |

January 28, 2009 | January 31, 2022 |

| Sarah Bloom Raskin Sarah Bloom Raskin Sarah Bloom Raskin is an American attorney and regulator, who is currently a member of the Board of Governors of the Federal Reserve System. Previously, she served as Maryland Commissioner of Financial Regulation.-Early life and education:... |

October 4, 2010 | January 31, 2016 |

| Vacant | —— |

Federal Open Market Committee

Federal Open Market Committee

The Federal Open Market Committee , a committee within the Federal Reserve System, is charged under United States law with overseeing the nation's open market operations . It is the Federal Reserve committee that makes key decisions about interest rates and the growth of the United States money...

(FOMC) created under comprises the seven members of the board of governors and five representatives selected from the regional Federal Reserve Banks. The FOMC is charged under law with overseeing open market operations, the principal tool of national monetary policy. These operations affect the amount of Federal Reserve balances available to depository institutions, thereby influencing overall monetary and credit conditions. The FOMC also directs operations undertaken by the Federal Reserve in foreign exchange markets. The representative from the Second District, New York, is a permanent member, while the rest of the banks rotate at two- and three-year intervals. All the presidents participate in FOMC discussions, contributing to the committee's assessment of the economy and of policy options, but only the five presidents who are committee members vote on policy decisions. The FOMC, under law, determines its own internal organization and by tradition elects the Chairman of the Board of Governors as its chairman and the president of the Federal Reserve Bank of New York as its vice chairman. Formal meetings typically are held eight times each year in Washington, D.C. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion. The FOMC generally meets eight times a year in Telephone consultations and other meetings are held when needed.

Federal Reserve Banks

Federal Reserve Note

A Federal Reserve Note is a type of banknote used in the United States of America. Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts. They are the only type of U.S...

s were created as part of the legislation to provide a supply of currency. The notes were to be issued to the Reserve Banks for subsequent transmittal to banking institutions. The various components of the Federal Reserve System have differing legal statuses.

Legal status

The Federal Reserve Banks have an intermediate legal status, with some features of private corporations and some features of public federal agencies. The United States has an interest in the Federal Reserve Banks as tax-exempt federally-created instrumentalities whose profits belong to the federal government, but this interest is not proprietary. Each member bank (commercial banks in the Federal Reserve district) owns a nonnegotiable share of stock in its regional Federal Reserve Bank. However, holding Federal Reserve Bank stock is unlike owning stock in a publicly traded company. The charter of each Federal Reserve Bank is established by law and cannot be altered by the member banks. Federal Reserve Bank stock cannot be sold or traded, and member banks do not control the Federal Reserve Bank as a result of owning this stock. They do, however, elect six of the nine members of the Federal Reserve Banks' boards of directors. In Lewis v. United States, the United States Court of Appeals for the Ninth CircuitUnited States Court of Appeals for the Ninth Circuit

The United States Court of Appeals for the Ninth Circuit is a U.S. federal court with appellate jurisdiction over the district courts in the following districts:* District of Alaska* District of Arizona...

stated that: "The Reserve Banks are not federal instrumentalities for purposes of the FTCA [the Federal Tort Claims Act

Federal Tort Claims Act

The Federal Tort Claims Act or "FTCA", , is a statute enacted by the United States Congress in 1948. "Federal Tort Claims Act" was also previously the official short title passed by the Seventy-ninth Congress on August 2, 1946 as Title IV of the Legislative Reorganization Act, 60 Stat...

], but are independent, privately owned and locally controlled corporations." The opinion went on to say, however, that: "The Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another relevant decision is Scott v. Federal Reserve Bank of Kansas City, in which the distinction is made between Federal Reserve Banks, which are federally-created instrumentalities, and the Board of Governors, which is a federal agency.

Board of Directors

The nine member board of directors of each district is made up of three classes, designated as classes A, B, and C. The directors serve a term of three years. The makeup of the boards of directors is outlined in U.S. Code, Title 12, Chapter 3, Subchapter 7:Class A

- three members

- chosen by and representative of the stockholding banks.

- member banks are divided into 3 groups based on size—large, medium, and small banks. Each group elects one member of Class A.

Class B

- three members

- no director of class B shall be an officer, director, or employee of any bank

- represent the public with due but not exclusive consideration to the interests of agriculture, commerce, industry, services, labor, and consumers.

- member banks are divided into three groups based on size—large, medium, and small banks. Each group elects one member of Class B.

Class C

- three members

- no director of class C shall be an officer, director, employee, or stockholder of any bank

- designated by the Board of Governors of the Federal Reserve System. They shall be elected to represent the public, and with due but not exclusive consideration to the interests of agriculture, commerce, industry, services, labor, and consumers.

- Shall have been for at least two years residents of the district for which they are appointed, one of whom shall be designated by said board as chairman of the board of directors of the Federal reserve bank and as Federal reserve agent.

A list of all of the members of the Reserve Banks' boards of directors is published by the Federal Reserve.

President

The Federal Reserve Act provides that the president of a Federal Reserve Bank shall be the chief executive officer of the Bank, appointed by the board of directors of the Bank, with the approval of the Board of Governors of the Federal Reserve System, for a term of five years.The terms of all the presidents of the twelve District Banks run concurrently, ending on the last day of February every five years. The appointment of a President who takes office after a term has begun ends upon the completion of that term. A president of a Reserve Bank may be reappointed after serving a full term or an incomplete term.

Reserve Bank presidents are subject to mandatory retirement upon becoming 65 years of age. However, presidents initially appointed after age 55 can, at the option of the board of directors, be permitted to serve until attaining ten years of service in the office or age 70, whichever comes first.

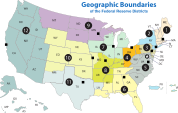

List of Federal Reserve Banks

The Federal Reserve Districts are listed below along with their identifying letter and number. These are used on Federal Reserve Notes to identify the issuing bank for each note. The 25 branches are also listed.| Federal Reserve Bank | Letter | Number | | Branches | Website | President |

|---|---|---|---|---|---|

| Boston Federal Reserve Bank of Boston The Federal Reserve Bank of Boston, commonly known as the Boston Fed, is responsible for the First District of the Federal Reserve, which covers most of Connecticut , Massachusetts, Maine, New Hampshire, Rhode Island and Vermont. It is headquartered in the Federal Reserve Bank Building in Boston,... |

A | 1 | http://www.bos.frb.org/ | Eric S. Rosengren Eric S. Rosengren Eric S. Rosengren took office on July 23, 2007, as the thirteenth president and chief executive officer of the Federal Reserve Bank of Boston, serving the First District. He serves the remainder of a term that began on March 1, 2006... |

|

| New York City Federal Reserve Bank of New York The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey,... |

B | 2 | Buffalo, New York (closed as of October 31, 2008) | http://www.newyorkfed.org/ | William C. Dudley |

| Philadelphia Federal Reserve Bank of Philadelphia The Federal Reserve Bank of Philadelphia, headquartered in Philadelphia, Pennsylvania, is responsible for the Third District of the Federal Reserve, which covers eastern Pennsylvania, the 9 southern counties of New Jersey, and Delaware... |

C | 3 | http://www.philadelphiafed.org/ | Charles I. Plosser | |

| Cleveland Federal Reserve Bank of Cleveland The Federal Reserve Bank of Cleveland is the Cleveland-based headquarters of the U.S. Federal Reserve System's Fourth District. The district is composed of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. It has branch offices in Cincinnati and Pittsburgh.... |

D | 4 | Cincinnati, Ohio / Pittsburgh, Pennsylvania | http://www.clevelandfed.org/ | Sandra Pianalto Sandra Pianalto Sandra Pianalto took office on February 1, 2003, as the tenth chief executive of the Fourth District Federal Reserve Bank, at Cleveland.... |

| Richmond Federal Reserve Bank of Richmond The Federal Reserve Bank of Richmond is the headquarters of the Fifth District of the Federal Reserve located in Richmond, Virginia. It covers the District of Columbia, Maryland, Virginia, North Carolina, South Carolina and most of West Virginia. Branch offices are located in Baltimore, Maryland... |

E | 5 | Baltimore, Maryland / Charlotte, North Carolina | http://www.richmondfed.org/ | Jeffrey M. Lacker Jeffrey M. Lacker Jeffrey M. Lacker is an American economist and president of the Federal Reserve Bank of Richmond. He is also a voting member of the Federal Open Market Committee for the year of 2009. Formerly, he was senior vice president and the director of research at the Federal Reserve Bank of... |

| Atlanta Federal Reserve Bank of Atlanta The Federal Reserve Bank of Atlanta is responsible for the sixth district, which covers the states of Alabama, Florida, and Georgia, 74 counties in the eastern two-thirds of... |

F | 6 | Birmingham, Alabama / Jacksonville, Florida / Miami, Florida / Nashville, Tennessee / New Orleans, Louisiana | http://www.frbatlanta.org/ | Dennis P. Lockhart Dennis P. Lockhart Dennis P. Lockhart is President and CEO of the Federal Reserve Bank of Atlanta. He assumed office on March 1, 2007.From 2003 to 2007, Lockhart served on the faculty of the Master of Science in Foreign Service Program at Georgetown University's Walsh School of Foreign Service. He also was an... |

| Chicago Federal Reserve Bank of Chicago The Federal Reserve Bank of Chicago is one of twelve regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the nation's central bank.... |

G | 7 | Detroit, Michigan / Des Moines, Iowa | http://www.chicagofed.org/ | Charles L. Evans Charles L. Evans Charles L. Evans is the ninth president and chief executive officer of the Federal Reserve Bank of Chicago. In that capacity, he serves on the Federal Open Market Committee , the Federal Reserve System's monetary policy-making body.Before becoming president in September 2007, Evans served as... |

| St Louis Federal Reserve Bank of St Louis The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the nation's central bank. Missouri is the only state to have two Federal Reserve Banks . The St... |

H | 8 | Little Rock, Arkansas / Louisville, Kentucky / Memphis, Tennessee | http://www.stlouisfed.org/ | James B. Bullard James B. Bullard James B. Bullard is the 12th president of the Federal Reserve Bank of St. Louis. He is currently serving a term that began on March 1, 2011. Dr. Bullard succeeded William Poole as president of the St. Louis Federal Reserve Bank on April 1, 2008.... |

| Minneapolis Federal Reserve Bank of Minneapolis The Federal Reserve Bank of Minneapolis, located in Minneapolis, Minnesota, in the United States, covers the 9th District of the Federal Reserve, including Minnesota, Montana, North and South Dakota, northwestern Wisconsin, and the Upper Peninsula of Michigan... |

I | 9 | Helena, Montana | http://www.minneapolisfed.org/ | Narayana R. Kocherlakota |

| Kansas City Federal Reserve Bank of Kansas City The Federal Reserve Bank of Kansas City covers the 10th District of the Federal Reserve, which includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, and portions of western Missouri and northern New Mexico. The Bank has branches in Denver, Oklahoma City, and Omaha. The current president is... |

J | 10 | Denver, Colorado / Oklahoma City, Oklahoma / Omaha, Nebraska | http://www.kansascityfed.org/ | Esther George Esther George Esther L. George is president and chief executive of the Federal Reserve Bank of Kansas City.George is a native of Faucett, Missouri, U.S., received a BSBA degree in Business Administration from Missouri Western State University an MBA degree from the University of Missouri-Kansas City... |

| Dallas Federal Reserve Bank of Dallas The Federal Reserve Bank of Dallas covers the Eleventh Federal Reserve District, which includes Texas, northern Louisiana and southern New Mexico.... |

K | 11 | El Paso, Texas / Houston, Texas / San Antonio, Texas | http://www.dallasfed.org/ | Richard W. Fisher Richard W. Fisher Richard W. Fisher is currently the President and CEO of the Federal Reserve Bank of Dallas, having assumed that post in April, 2005.-Career:... |

| San Francisco Federal Reserve Bank of San Francisco The Federal Reserve Bank of San Francisco is the federal bank for the twelfth district in the United States. The twelfth district is made up of nine western states-—Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington--plus the Northern Mariana Islands, American Samoa,... |

L | 12 | Los Angeles, California / Portland, Oregon / Salt Lake City, Utah / Seattle, Washington | http://www.frbsf.org/ | Janet L. Yellen Janet Yellen Janet Louise Yellen is an American economist and professor, who is currently the Vice Chair of the Board of Governors of the Federal Reserve System... |

Primary dealers

A primary dealer is a bankBank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

or securities broker-dealer

Broker-dealer

A broker-dealer is a term used in United States financial services regulations. It is a natural person, a company or other organization that trades securities for its own account or on behalf of its customers....

that may trade directly with the Federal Reserve System of the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

. They are required to make bids or offers when the Fed conducts open market operations, provide information to the Fed's open market trading desk, and to participate actively in U.S. Treasury

United States Department of the Treasury

The Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

securities auctions. They consult with both the U.S. Treasury and the Fed about funding the budget deficit and implementing monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

. Many former employees of primary dealers work at the Treasury, because of their expertise in the government debt markets, though the Fed avoids a similar revolving door

Revolving door (politics)

The revolving door is the movement of personnel between roles as legislators and regulators and the industries affected by the legislation and regulation and on within lobbying companies. In some cases the roles are performed in sequence but in certain circumstances may be performed at the same time...

policy.

Between them, these dealers purchase the vast majority of the U.S. Treasury securities (T-bills, T-notes, and T-bonds) sold at auction, and resell them to the public. Their activities extend well beyond the Treasury market, for example, according to the Wall Street Journal Europe (2/9/06 p. 20), all of the top ten dealers in the foreign exchange market

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

are also primary dealers, and between them account for almost 73% of forex trading volume. Arguably, this group's members are the most influential and powerful non-governmental institutions in world financial markets.

The primary dealers form a worldwide network that distributes new U.S. government debt. For example, Daiwa Securities and Mizuho Securities distribute the debt to Japanese buyers. BNP Paribas, Barclays, Deutsche Bank, and RBS Greenwich Capital

RBS Greenwich Capital

RBS Securities Inc. is the Royal Bank of Scotland Group's U.S. investment bank/broker-dealer based in Stamford, Connecticut that specializes in fixed income arbitrage and other fixed income strategies...

(a division of the Royal Bank of Scotland

Royal Bank of Scotland

The Royal Bank of Scotland Group is a British banking and insurance holding company in which the UK Government holds an 84% stake. This stake is held and managed through UK Financial Investments Limited, whose voting rights are limited to 75% in order for the bank to retain its listing on the...

) distribute the debt to European buyers. Goldman Sachs, and Citigroup account for many American buyers. Nevertheless, most of these firms compete internationally and in all major financial centers.

Current list of primary dealers

As of July 27, 2009 according to the Federal Reserve Bank of New YorkFederal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, NY. It is responsible for the Second District of the Federal Reserve System, which encompasses New York state, the 12 northern counties of New Jersey,...

the list includes:

The Primary Dealers List is available at the Federal Reserve Bank of New York website. Changes are available at Changes to Primary Dealers List.

Five notable changes to the list have occurred in 2008. Countrywide Securities Corporation

Countrywide Financial

Bank of America Home Loans is the mortgage unit of Bank of America. Bank of America Home Loans is composed of:*Mortgage Banking, which originates purchases, securitizes, and services mortgages. In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion...

was removed on July 15 due to its acquisition by Bank of America. Lehman Brothers Inc.

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

was removed on September 22 due to bankruptcy. Bear Stearns

Bear Stearns

The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession...

& Co. Inc. was removed from the list on October 1 due to its acquisition by J.P. Morgan Chase. On February 11, 2009, Merrill Lynch Government Securities Inc.

Merrill Lynch

Merrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

was removed from the list due to its acquisition by Bank of America.

Member Banks

Each member bank is a private bank (e.g., a privately owned corporation) that holds stock in one of the twelve regional Federal Reserve banks. The amount of stock each member bank must buy is set to be equal to 3% of its combined capital and surplus of stock in the Reserve Bank within its region of the Federal Reserve System. All of the commercial banks in the United States can be divided into three types according to which governmental body charters them and whether or not they are members of the Federal Reserve System:| Type | Definition |

|---|---|

| national banks | Those chartered by the federal government (through the Office of the Comptroller of the Currency in the Department of the Treasury); by law, they are members of the Federal Reserve System |

| state member banks | Those chartered by the states who are members of the Federal Reserve System. |

| state nonmember banks | Those chartered by the states who are not members of the Federal Reserve System. |

All nationally chartered banks hold stock in one of the Federal Reserve banks. State-chartered banks may choose to be members (and hold stock in a regional Federal Reserve bank), upon meeting certain standards.

Holding stock in a Federal Reserve bank is not, however, like owning publicly traded stock. The stock cannot be sold or traded. Member banks receive a fixed, 6% dividend annually on their stock, and they do not directly control the applicable Federal Reserve bank as a result of owning this stock. They do, however, elect six of the nine members of Reserve banks' boards of directors. Federal statute provides (in part): "Every national bank in any State shall, upon commencing business or within ninety days after admission into the Union of the State in which it is located, become a member bank of the Federal Reserve System by subscribing and paying for stock in the Federal Reserve bank of its district in accordance with the provisions of this chapter and shall thereupon be an insured bank under the Federal Deposit Insurance Act [. . . .]"

Other banks may elect to become member banks. According to the Federal Reserve Bank of Boston:

For example, as of October 2006 the member banks in New Hampshire included Community Guaranty Savings Bank, The Lancaster National Bank, The Pemigewasset National Bank of Plymouth, and other banks. In California, member banks, as of September 2006, included Bank of America California, National Association, The Bank of New York Trust Company, National Association, Barclays Global Investors, National Association, and many other banks.

List of member banks

The majority of U.S. banks are not members of the Federal Reserve System.

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

(FDIC)-insured banks. national banks (N) and state members (SM) are members of the Federal Reserve System while the rest of the FDIC-insured banks are not members.

Each charter type is defined as follows:

- N = commercial bank, national (federal) charter and Fed member, supervised by the Office of the Comptroller of the CurrencyOffice of the Comptroller of the CurrencyThe Office of the Comptroller of the Currency is a US federal agency established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and the federal branches and agencies of foreign banks in the United States...

(OCC) – Dept of TreasuryUnited States Department of the TreasuryThe Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

- SM = commercial bank, state charter and Fed member, supervised by the Federal Reserve (FRB)

- NM = commercial bank, state charter and Fed nonmember, supervised by the FDIC

- OI = insured U.S. branch of a foreign chartered institution (IBA)

- SA = savings associations, state or federal charter, supervised by the Office of Thrift SupervisionOffice of Thrift SupervisionThe Office of Thrift Supervision was a United States federal agency under the Department of the Treasury that charters, supervises, and regulates all federally- and state-chartered savings banks and savings and loans associations. It was created in 1989 as a renamed version of another federal agency...

(OTS)

- SB = savings bankSavings bankA savings bank is a financial institution whose primary purpose is accepting savings deposits. It may also perform some other functions.In Europe, savings banks originated in the 19th or sometimes even the 18th century. Their original objective was to provide easily accessible savings products to...

s, state charter, supervised by the FDIC

While the OI, SA, and SB categories are not members of the system, they are sometimes treated as if they were members under certain circumstances.

A list of all member banks can be found at the website of the Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

(FDIC). Most commercial banks in the United States are not members of the Federal Reserve System, but the total value of all the banking assets of member banks is substantially larger than the total value of the banking assets of nonmembers.

Advisory committees

The Federal Reserve System uses advisory committees in carrying out its varied responsibilities. Three of these committees advise the Board of Governors directly:- Federal Advisory CouncilFederal Advisory Council-Membership:*President - William Downe*Vice President - Lyle R. Knight*First District - Ellen Alemany*Second District - Robert P. Kelley*Third District - R. Scott Smith, Jr.*Fourth District - Henry L. Meyer III*Fifth District - Kenneth D. Lewis...

- Consumer Advisory Council

- Thrift Institutions Advisory Council

Of these advisory committees, perhaps the most important are the committees (one for each Reserve Bank) that advise the Banks on matters of agriculture, small business, and labor. Biannually, the Board solicits the views of each of these committees by mail.