Financial contagion

Encyclopedia

Fire sale

A fire sale is the sale of goods at extremely discounted prices, typically when the seller faces bankruptcy or other impending distress. The term may originally have been based on the sale of goods at a heavy discount due to fire damage...

, thereby undermining confidence in similar banks. An example of this phenomenon is the failure of Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

and the subsequent turmoil in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

financial markets. International financial contagion, which happens in both advanced economies and developing economies, is the transmission of financial crisis across financial markets for direct or indirect economies. However, under today's financial system, with large volume of cash flow

Cash flow

Cash flow is the movement of money into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation.Cash flow...

, such as hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

and cross-regional operation of large banks, financial contagion usually happens simultaneously both among domestic institutions and across countries. The cause of financial contagion usually is beyond the explanation of real economy, such as the bilateral trade volume.

History

While there was a period of systemic crisis in emerging countries in the early 1980s, both academia and policy circles did not analyze the crisis from a systematic point of view. Even when Latin American countries fell like dominoes into an abyss of successive devaluations, banking crises and deep recessions, much of the blame was placed on poor domestic policies and high real interest rates in the United States, with little attention focusing on the possibility that financial crises could be spreading and contagious. A Lexis-Nexis search for contagion before 1997 finds hundreds of examples in major newspapers, almost none of which refer to turmoil in international financial markets. The term “contagionContagion

Contagion may refer to:In medicine:* Infectious disease, also known as contagious disease, with infection, or the infectious agent, also known as contagionIn media* Batman: Contagion, a story arc in the Batman comic book series...

” was first introduced in July 1997, when the currency crisis in Thailand quickly spread throughout East Asia and then on to Russia and Brazil. Even developed markets in North America and Europe were affected, as the relative prices of financial instruments shifted and caused the collapse of Long-Term Capital Management

Long-Term Capital Management

Long-Term Capital Management L.P. was a speculative hedge fund based in Greenwich, Connecticut that utilized absolute-return trading strategies combined with high leverage...

(LTCM), a large U.S. hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

. The financial crisis beginning from Thailand

Thailand

Thailand , officially the Kingdom of Thailand , formerly known as Siam , is a country located at the centre of the Indochina peninsula and Southeast Asia. It is bordered to the north by Burma and Laos, to the east by Laos and Cambodia, to the south by the Gulf of Thailand and Malaysia, and to the...

with the collapse of the Thai baht

Thai baht

The baht is the currency of Thailand. It is subdivided into 100 satang . The issuance of currency is the responsibility of the Bank of Thailand.-History:The baht, like the pound, originated from a traditional unit of mass...

spread to Indonesia

Indonesia

Indonesia , officially the Republic of Indonesia , is a country in Southeast Asia and Oceania. Indonesia is an archipelago comprising approximately 13,000 islands. It has 33 provinces with over 238 million people, and is the world's fourth most populous country. Indonesia is a republic, with an...

, the Philippines

Philippines

The Philippines , officially known as the Republic of the Philippines , is a country in Southeast Asia in the western Pacific Ocean. To its north across the Luzon Strait lies Taiwan. West across the South China Sea sits Vietnam...

, Malaysia, South Korea

South Korea

The Republic of Korea , , is a sovereign state in East Asia, located on the southern portion of the Korean Peninsula. It is neighbored by the People's Republic of China to the west, Japan to the east, North Korea to the north, and the East China Sea and Republic of China to the south...

and Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

in less than 2 months. After that, economists realized the importance of financial contagion and produced a large volume of researches on it.

Explanations

There are several branches of literatures explaining the mechanism of financial contagion.One branch of them emphasizes contagious currency crises, relating such crises to various monetary and financial sector vulnerabilities and trade factors. These studies often look for the underlying causes behind a simultaneous set of speculative attacks. For instance, Goldfajn and valdés (1997) find that the intermediaries' role of transforming maturities is shown to result in larger movements of capital and a higher probability of crisis, which resemble the observed cycle in capital flows: large inflows, crisis and abrupt outflows. Kaminsky and Reinhart (2000) document the evidence that trade links in goods and services and exposure to a common creditor

Creditor

A creditor is a party that has a claim to the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property or service to the second party under the assumption that the second party will return an equivalent property or...

can explain earlier crises clusters, not only the debt crisis

Debt crisis

The debt crisis is the general term for the proliferation of massive state debts relative to tax revenues, especially in reference to Latin American during the 1980s, and the United States and the European Union since the mid-2000s.-See also:...

of the early 1980s and 1990s, but also the observed historical pattern of contagion.

The second branch of literatures explain contagion transmission as a result of linkages among financial institutions. Alen and Gale (2000) and Lagunoff and Schreft (2001) analyze financial contagion as a result of linkages among financial intermediaries. The former provide a general equilibrium model to explain a small liquidity preference

Liquidity preference

In macroeconomic theory, Liquidity preference refers to the demand for money, considered as liquidity. The concept was first developed by John Maynard Keynes in his book The General Theory of Employment, Interest and Money to explain determination of the interest rate by the supply and demand...

shock in one region can spread by contagion throughout the economy and the possibility of contagion depends strongly on the completeness of the structure of interregional claims

Cause of action

In the law, a cause of action is a set of facts sufficient to justify a right to sue to obtain money, property, or the enforcement of a right against another party. The term also refers to the legal theory upon which a plaintiff brings suit...

. The latter proposed a dynamic stochastic game-theoretic model of financial fragility, through which they explain interrelated portfolios and payment commitments forge financial linkages among agents and thus make two related types of financial crisis can occur in response. In addition, Van Rijckeghem and Weder (2000) presents evidence that spillovers through bank lending contributed to the transmission of currency crises during the recent episodes of financial instability in emerging markets. Besides, in an era of rapid financial globalisation, Gai and Kapadia (2010) prove that while high connectivity may increase the spread of financial contagion and adverse aggregate shocks and liquidity risk also amplify the likelihood and extent of financial contagion.

The third branch emphasize financial contagion among financial markets. This stream of researches try to explain contagion through a correlated information or a correlated liquidity shock channel. Under the correlated information channel, price changes in one market are perceived as having implications for the values of assets in other markets, causing their prices to change as well (King and Wadhwani (1990)). Also,Calvo (1999) argues for correlated liquidity shock channel meaning that when some market participants need to liquidate and withdrawal some of their assets to obtain cash, perhaps after experiencing an unexpected loss in another country and need to restore capital adequacy ratios. This behavior will effectively transmit the shock.

In addition, there are some less-developed explanations for financial contagion. Some explanations for financial contagion, especially after the Russian default in 1998, are based on changes in investor “psychology”, “attitude” and “behavior”. This stream of research date back to early studies of crowd psychology of Mackay (1841) and classical early models of disease diffusion were applied to financial markets by Shiller (1984). Also, Kirman (1993) analyses a simple model of influence that is motivated by the foraging behaviour of ants, but applicable, he argues, to the behaviour of stock market investors. Faced with a choice between two identical piles of food, ants switch periodically from one pile to the other. Kirman supposes that there are N ants and that each switches randomly between piles with probability ε (this prevents the system getting stuck with all at one pile or the other), and imitates a randomly chosen other ant with probability δ. Eichengreen, Hale and Mody (2008) focus on the transmission of recent crises through the market for developing country debt. They find the impact of changes in market sentiment tends to be limited to the original region. They also find market sentiments can more influence prices but less on quantities in Latin America, compared with Asian countries.

Besides, there are some researches on geographic factors driving the contagion. De Gregorio and Valdes (2008) examine how the 1982 debt crisis, the 1994 Mexican crisis, and the 1997 Asian crisis spread to a sample of twenty other countries. They find that a neighborhood effect is the strongest determinant of which countries suffer from contagion. Trade links and pre-crisis growth similarities are also important, although to a lesser extent than the neighborhood effect.

A Simple Empirical Model

The empirical literature on testing for contagion has focused on increases in the correlation of returns between markets during periods of crisis. Forbes and Rigobon (2002) begin by discussing the current imprecision and disagreement surrounding the term contagion. It proposes a concrete definition, a significant increase in cross-market linkages after a shock, and suggests using the term “interdependence” in order to differentiate this explicit definition from the existing literature. It shows the elementary weakness of simple correlation tests: with an unchanged regression coefficientCoefficient

In mathematics, a coefficient is a multiplicative factor in some term of an expression ; it is usually a number, but in any case does not involve any variables of the expression...

, a rise in the variance

Variance

In probability theory and statistics, the variance is a measure of how far a set of numbers is spread out. It is one of several descriptors of a probability distribution, describing how far the numbers lie from the mean . In particular, the variance is one of the moments of a distribution...

of the explanatory variable reduces the coefficient standard error

Standard error

Standard error can refer to:* Standard error , the estimated standard deviation or error of a series of measurements* Standard error stream, one of the standard streams in Unix-like operating systems...

, causing a rise in the correlation of a regression.

The regression underlying contagion tests is as follows:

Xt=θ(L)Xt+Θ(L)It+ξt (1)

Xt={xtc,xtj} (2)

It={itc, itUS, itj} (3)

where t is the time period for all variables; xc is the stock market return in the crisis country;, xj is the stock market return in another market j; Xt is a transposed vector of returns in the same two stock markets; Θ(L) and θ(L) are vectors of lags; ic, ius, and ij are short-term interest rates for the crisis country, the United States, and country j, respectively; and ξt is a vector of reduced-form disturbances. For each series of tests, they first use the VAR(vector autoregression

Vector autoregression

Vector autoregression is a statistical model used to capture the linear interdependencies among multiple time series. VAR models generalize the univariate autoregression models. All the variables in a VAR are treated symmetrically; each variable has an equation explaining its evolution based on...

) model in equations (1) through (3) to estimate the ariance-covariance] matrices for each pair of countries during the stable period, turmoil period, and full period. Then we use the estimated variance-covariance matrices to calculate the cross-market correlation

Correlation

In statistics, dependence refers to any statistical relationship between two random variables or two sets of data. Correlation refers to any of a broad class of statistical relationships involving dependence....

coefficients (and their asymptotic distributions

Probability distribution

In probability theory, a probability mass, probability density, or probability distribution is a function that describes the probability of a random variable taking certain values....

) for each set of markets and periods.

As Pesaran and Pick (2007) observe, however, financial contagion a difficult system to estimate econometrically. To disentangle contagion from interaction effects, county-specific variables have to be used to instrument foreign returns. Choosing the crisis period introduces sample selection bias, and it has to be assumed that crisis periods are sufficiently long to allow correlations to be reliably estimated. In consequence, there appears to be no strong consensus in the empirical literature as to whether contagion occurs between markets, or how strong it is.

Controversy

Some argue that strong linkages between countries are not necessarily contagion, and that contagion should be defined as an increase in cross-market linkages after a shock to one country, which is very hard to figure out by both theoretical model and empirical work. Also, some scholars argue that there is actually no contagion at all, just a high level of market comovement in all periods, which is market "interdependence."Policy Implications

Financial contagion is one of the main causes of financial regulationFinancial regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the integrity of the financial system...

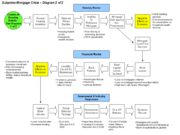

. How to make domestic financial regulation and plan the international financial architecture to prevent financial contagion become the top priority for both domestic financial regulators and international society, say, G-20 summit, especially when the global economy are being under challenge from the US Subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

and European sovereign debt crisis.

At international level, under today's modern financial systems, a complicated web of claims and obligations link the balance sheets of a wide variety of intermediaries, such as hedge funds and banks, into a global financial network. The development of sophisticated financial products, such as credit default swaps and collateralised debt obligations, has complicated the financial regulation. As has been shown by the US financial recession, the trigger of failure of Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

dramatically spread the shock to whole financial system and other financial markets. Therefore, understanding the reasons and mechanisms of international financial contagion can help policy makers improve the global financial regulation system and thus make it more resistant to shocks and contagions.

At domestic level, financial fragility is always associated with a short maturity of outstanding debt as well as contingent public liabilities. Therefore, a better domestic financial regulation structure can improve an economy’s liquidity and limit its exposure to contagion. A better understanding of financial contagion between financial intermediaries, including banking, rating agencies and hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

will be conducive to making financial reform in both US and European Countries, say how to set up the capital ratio to jungle the balance between maximizing banks' profit

Profit (accounting)

In accounting, profit can be considered to be the difference between the purchase price and the costs of bringing to market whatever it is that is accounted as an enterprise in terms of the component costs of delivered goods and/or services and any operating or other expenses.-Definition:There are...

and shielding them from shocks and contagions.