Venture capital financing

Encyclopedia

Venture capital financing is a type of financing by venture capital

: the type of private equity capital is provided as seed funding to early-stage, high-potential, growth companies and more often after the seed funding round as growth funding round (also referred as series A round) in the interest of generating a return through an eventual realization event such as an IPO or trade sale of the company.

or to bring a new product to the market, the venture may need to attract financial funding. There are several categories of financing possibilities. If it is a small venture, then perhaps the venture can rely on family funding, loans from friends, personal bank loans or crowd funding

.

For more ambitious projects, some companies need more than what mentioned above, some ventures have access to rare funding resources called angel investor

s. These are private investors who are using their own capital to finance a ventures’ need. The Harvard report by William R. Kerr, Josh Lerner, and Antoinette Schoar tables evidence that angel-funded startup companies are less likely to fail than companies that rely on other forms of initial financing. Apart from these investors, there are also venture capitalist firms (VC-firms

) who are specialized in financing

new ventures against a lucrative return.

When a venture approaches the last one, the venture is going to do more than negotiating about the financial terms. Apart from the financial resources these firms are offering; the VC-firm also provides potential expertise the venture is lacking, such as legal or marketing knowledge. This is also known as "smart money".

Of course the stages can be extended by as many stages as the VC-firm thinks it should be needed, which is done in practice all the time. This is done when the venture did not perform as the VC-firm expected. This is generally caused by bad management or because the market collapsed or a bit of both (see: Dot com boom). The next paragraphs will go into more details about each stage.

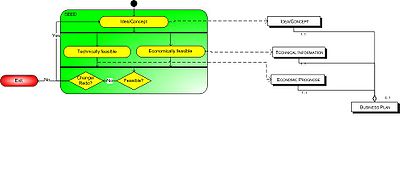

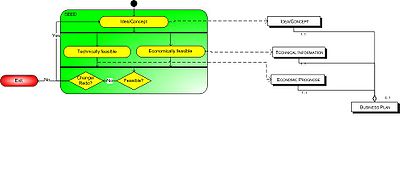

The following schematics shown here are called the process data models. All activities that find place in the venture capital financing process are displayed at the left side of the model. Each box stands for a stage of the process and each stage has a number of activities. At the right side, there are concepts. Concepts are visible products/data gathered at each activity. This diagram is according to the modeling technique founded by Professor Sjaak Brinkkemper

of the University of Utrecht in the Netherlands.

This is where the seed funding takes place. It is considered as the setup stage where a person or a venture approaches an angel investor

This is where the seed funding takes place. It is considered as the setup stage where a person or a venture approaches an angel investor

or an investor in a VC-firm for funding for their idea/product. During this stage, the person or venture has to convince the investor why the idea/product is worthwhile. The investor will investigate into the technical and the economical feasibility (Feasibility Study

) of the idea. In some cases, there is some sort of prototype of the idea/product that is not fully developed or tested.

If the idea is not feasible at this stage, and the investor does not see any potential in the idea/product, the investor will not consider financing the idea. However if the idea/product is not directly feasible, but part of the idea is worth for more investigation, the investor may invest some time and money in it for further investigation.

Example:

A Dutch venture named High 5 Business Solution V.O.F. wants to develop a portal which allows companies to order lunch. To open this portal, the venture needs some financial resources, they also need marketeers and market researchers to investigate whether there is a market for their idea. To attract these financial and non-financial resources, the executives of the venture decide to approach ABN AMRO Bank to see if the bank is interested in their idea.

After a few meetings, the executives are successful in convincing the bank to take a look in the feasibility of the idea. ABN AMRO decides to put a few experts for investigation. After two weeks time, the bank decides to invest. They come to an agreement of invest a small amount of money into the venture. The bank also decides to provide a small team of marketeers and market researchers and a supervisor. This is done to help the venture with the realization of their idea and to monitor the activities in the venture.

Risk

At this stage, the risk of losing the investment is tremendously high, because there are so many uncertain factors. From research, we know that the risk of losing the investment for the VC-firm is around the 66.2% and the causation of major risk by stage of development is 72%. These percentages are based on the research done by Ruhnka, J.C. and Young, J.E.

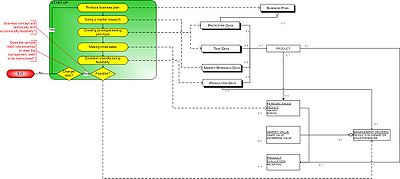

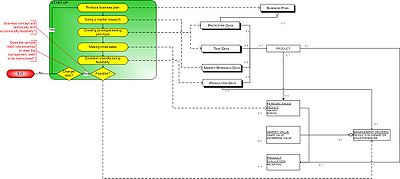

If the idea/product/process is qualified for further investigation and/or investment, the process will go to the second stage; this is also called the start-up stage. At this point many exciting things happen. A business plan

If the idea/product/process is qualified for further investigation and/or investment, the process will go to the second stage; this is also called the start-up stage. At this point many exciting things happen. A business plan

is presented by the attendant of the venture to the VC-firm. A management team is being formed to run the venture. If the company has a board of directors, a person from the VC-firms will take seats at the board of directors.

While the organisation is being set up, the idea/product gets its form. The prototype is being developed and fully tested. In some cases, clients are being attracted for initial sales. The management-team establishes a feasible production line to produce the product. The VC-firm monitors the feasibility of the product and the capability of the management-team from the Board of directors

.

To prove that the assumptions of the investors are correct about the investment, the VC-firm wants to see result of market research

to see whether the market size is big enough, if there are enough consumers to buy their product. They also want to create a realistic forecast of the investment needed to push the venture into the next stage. If at this stage, the VC-firm is not satisfied about the progress or result from market research, the VC-firm may stop their funding and the venture will have to search for another investor(s). When the cause relies on handling of the management in charge, they will recommend replacing (parts of) the management team.

Example

Now the venture has attracted an investor, the venture need to satisfy the investor for further investment. To do that, the venture needs to provide the investor a clear business plan how to realise their idea and how the venture is planning to earn back the investment that is put into the venture, of course with a lucrative return.

Together with the market researchers, provided by the investor, the venture has to determine how big the market is in their region. They have to find out who are the potential clients and if the market is big enough to realise the idea.

From market research, the venture comes to know that there are enough potential clients for their portal site. But there are no providers of lunches yet. To convince these providers, the venture decided to do interviews with providers and try to convince them to join.

With this knowledge, the venture can finish their business plan and determine a pretty good forecast of the revenue, the cost of developing and maintaining the site and the profit the venture will earn in the following five years.

After reading the business plan and consulting the person who monitors the venture activities, the investor decides that the idea is worth for further development.

Risk

At this stage, the risk of losing the investment is shrinking, because the uncertainty is becoming clearer. The risk of losing the investment for the VC-firm is dropped to 53.0%, but the causation of major risk by stage of development becomes higher, which is 75.8%. This can be explained by the fact because the prototype was not fully developed and tested at the seed stage. And the VC-firm has underestimated the risk involved. Or it could be that the product and the purpose of the product have been changed during the development.

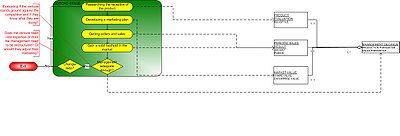

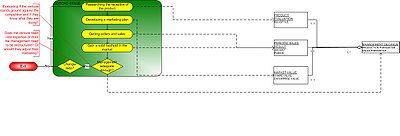

At this stage, we presume that the idea has been transformed into a product and is being produced and sold. This is the first encounter with the rest of the market, the competitors. The venture is trying to squeeze between the rest and it tries to get some market share from the competitors. This is one of the main goals at this stage. Another important point is the cost

At this stage, we presume that the idea has been transformed into a product and is being produced and sold. This is the first encounter with the rest of the market, the competitors. The venture is trying to squeeze between the rest and it tries to get some market share from the competitors. This is one of the main goals at this stage. Another important point is the cost

. The venture is trying to minimize their losses in order to reach the break-even

.

The management-team has to handle very decisively. The VC-firm monitors the management capability of the team. This consists of how the management-team manages the development process of the product and how they react to competition.

If at this stage the management-team is proven their capability of standing hold against the competition, the VC-firm will probably give a go for the next stage. However, if the management team lacks in managing the company or does not succeed in competing with the competitors, the VC-firm may suggest for restructuring of the management team and extend the stage by redoing the stage again. In case the venture is doing tremendously bad whether it is caused by the management team or from competition, the venture will cut the funding.

Example

The portal site needs to be developed. (If possible, the development should be taken place in house. If not, the venture needs to find a reliable designer to develop the site.) Developing the site in house is not possible; the venture does not have this knowledge in house. The venture decides to consult this with the investor. After a few meetings, the investor decides to provide the venture a small team of web-designers. The investor also has given the venture a deadline when the portal should be operational. The deadline is in 3 months.

In the meantime, the venture needs to produce a client-portfolio, who will provide their menu at the launch of the portal site. The venture also needs to come to an agreement how these providers are being promoted at the portal site and against what price.

After 3 months, the investor requests the status of development. Unfortunately for the venture, the development did not go as planned. The venture did not make the deadline. According to the one who is monitoring the activities, this is caused by the lack of decisiveness by the venture and the lack of skills of the designers.

The investor decides to cut back their financial investment after a long meeting. The venture is given another 3 months to come up with an operational portal site. Three designers are being replaced by a new designer and a consultant is attracted to support the executives’ decisions. If the venture does not make this deadline in time, they have to find another investor.

Luckily for the venture, with the come of the new designer and the consultant, the venture succeeds in making the deadline. They even have 2 weeks left before the second deadline ends.

Risk

At this stage, the risk of losing the investment still drops, because the venture is capable to estimate the risk. The risk of losing the investment for the VC-firm drops from 53.0% to 33.7%, and the causation of major risk by stage of development also drops at this stage, from 75.8% to 53.0%. This can be explained by the fact that there is not much developing going on at this stage. The venture is concentrated in promoting and selling the product. That is why the risk decreases.

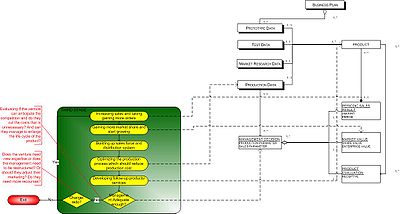

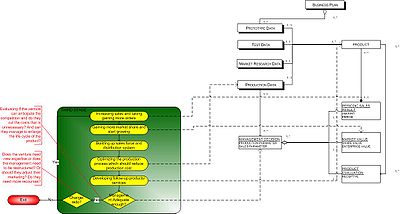

This stage is seen as the expansion/maturity phase of the previous stage. The venture tries to expand the market share they gained in the previous stage. This can be done by selling more amount of the product and having a good marketing campaign. Also, the venture will have to see whether it is possible to cut down their production cost or restructure the internal process. This can become more visible by doing a SWOT

This stage is seen as the expansion/maturity phase of the previous stage. The venture tries to expand the market share they gained in the previous stage. This can be done by selling more amount of the product and having a good marketing campaign. Also, the venture will have to see whether it is possible to cut down their production cost or restructure the internal process. This can become more visible by doing a SWOT

analysis. It is used to figure out the strength, weakness, opportunity and the threat the venture is facing and how to deal with it.

Except that the venture is expanding, the venture also starts to investigate follow-up products and services. In some cases, the venture also investigates how to expand the life-cycle

of the existing product/service.

At this stage the VC-firm monitors the objectives already mentioned in the second stage and also the new objective mentioned at this stage. The VC-firm will evaluate if the management-team has made the expected reduction cost. They also want to know how the venture competes against the competitors. The new developed follow-up product will be evaluated to see if there is any potential.

Example

Finally the portal site is operational. The portal is getting more orders from the working class every day. To keep this going, the venture needs to promote their portal site. The venture decides to advertise by distributing flyers at each office in their region to attract new clients.

In the meanwhile, a small team is being assembled for sales, which will be responsible for getting new lunchrooms/bakeries, any eating-places in other cities/region to join the portal site. This way the venture also works on expanding their market.

Because of the delay at the previous stage, the venture did not fulfil the expected target. From a new forecast, requested by the investor, the venture expects to fulfil the target in the next quarter or the next half year. This is caused by external issues the venture does not have control of it. The venture has already suggested to stabilise the existing market the venture already owns and to decrease the promotion by 20% of what the venture is spending at the moment. This is approved by the investor.

Risk

At this stage, the risk of losing the investment for the VC-firm drops with 13.6% to 20.1%, and the causation of major risk by stage of development drops almost by half from 53.0% to 37.0%. However at this stage it happens often that new follow-up products are being developed. The risk of losing the investment is still decreasing. This may because the venture rely its income on the existing product. That is why the percentage continuous drop.

In general this stage is the last stage of the venture capital financing process. The main goal of this stage is to achieve an exit vehicle for the investors and for the venture to go public. At this stage the venture achieves a certain amount of the market share. This gives the venture some opportunities like for example:

In general this stage is the last stage of the venture capital financing process. The main goal of this stage is to achieve an exit vehicle for the investors and for the venture to go public. At this stage the venture achieves a certain amount of the market share. This gives the venture some opportunities like for example:

Internally, the venture has to reposition

the product and see where the product is positioned and if it is possible to attract new Market segmentation. This is also the phase to introduce the follow-up product/services to attract new clients and markets.

As we already mentioned, this is the final stage of the process. But most of the time, there will be an additional continuation stage involved between the third stage and the Bridge/pre-public stage. However there are limited circumstances known where investors made a very successful initial market impact might be able to move from the third stage directly to the exit stage. Most of the time the venture fails to achieves some of the important benchmarks the VC-firms aimed.

Example

Now the site is running smoothly, the venture is thinking about taking over the competitors’ website happen.nl. The site is promoting restaurants and is also doing business in online ordering food. This proposal is being protested by the investor, because it may cost a lot of the ventures’ capital. The investor suggests a merge instead.

To settle down their differences, the venture requested an external party to investigate into the case. The result of the investigation was a take-over. After reading the investigation, the investor agrees to it and happen.nl is being taken over by the venture. With the take-over of a competitor, the venture has expanded its services.

Seeing the ventures’ result, the investor comes to the conclusion that the venture still have not reach the target that was expected, but seeing how the business is progressing, the investor decides to extend its investment for another year.

Risk

At this final stage, the risk of losing the investment still exists. However, compared with the numbers mentioned at the seed-stage it is far lower. The risk of losing the investment the final stage is a little higher at 20.9%. This is caused by the number of times the VC-firms may want to expand the financing cycle, not to mention that the VC-firm is faced with the dilemma of whether to continuously invest or not. The causation of major risk by this stage of development is 33%. This is caused by the follow-up product that is introduced.

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

: the type of private equity capital is provided as seed funding to early-stage, high-potential, growth companies and more often after the seed funding round as growth funding round (also referred as series A round) in the interest of generating a return through an eventual realization event such as an IPO or trade sale of the company.

Overview

To start a new startup companyStartup company

A startup company or startup is a company with a limited operating history. These companies, generally newly created, are in a phase of development and research for markets...

or to bring a new product to the market, the venture may need to attract financial funding. There are several categories of financing possibilities. If it is a small venture, then perhaps the venture can rely on family funding, loans from friends, personal bank loans or crowd funding

Crowd funding

Crowd funding describes the collective cooperation, attention and trust by people who network and pool their money and other resources together, usually via the Internet, to support efforts initiated by other people or organizations...

.

For more ambitious projects, some companies need more than what mentioned above, some ventures have access to rare funding resources called angel investor

Angel investor

An angel investor or angel is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity...

s. These are private investors who are using their own capital to finance a ventures’ need. The Harvard report by William R. Kerr, Josh Lerner, and Antoinette Schoar tables evidence that angel-funded startup companies are less likely to fail than companies that rely on other forms of initial financing. Apart from these investors, there are also venture capitalist firms (VC-firms

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

) who are specialized in financing

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

new ventures against a lucrative return.

When a venture approaches the last one, the venture is going to do more than negotiating about the financial terms. Apart from the financial resources these firms are offering; the VC-firm also provides potential expertise the venture is lacking, such as legal or marketing knowledge. This is also known as "smart money".

Venture Capital Financing Process

As written in the previous paragraph, there are several ways to attract funding. However in general, the venture capital financing process can be distinguished into five stages;- The Seed stage

- The Start-up stage

- The Second stage

- The Third stage

- The Bridge/Pre-public stage

Of course the stages can be extended by as many stages as the VC-firm thinks it should be needed, which is done in practice all the time. This is done when the venture did not perform as the VC-firm expected. This is generally caused by bad management or because the market collapsed or a bit of both (see: Dot com boom). The next paragraphs will go into more details about each stage.

The following schematics shown here are called the process data models. All activities that find place in the venture capital financing process are displayed at the left side of the model. Each box stands for a stage of the process and each stage has a number of activities. At the right side, there are concepts. Concepts are visible products/data gathered at each activity. This diagram is according to the modeling technique founded by Professor Sjaak Brinkkemper

Sjaak Brinkkemper

Jacobus Nicolaas Brinkkemper is a Dutch computer scientist, and Full Professor of organisation and information at the Department of Information and Computing Sciences of Utrecht University.-Biography:...

of the University of Utrecht in the Netherlands.

The Seed Stage

Angel investor

An angel investor or angel is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity...

or an investor in a VC-firm for funding for their idea/product. During this stage, the person or venture has to convince the investor why the idea/product is worthwhile. The investor will investigate into the technical and the economical feasibility (Feasibility Study

Feasibility study

Feasibility studies aim to objectively and rationally uncover the strengths and weaknesses of the existing business or proposed venture, opportunities and threats as presented by the environment, the resources required to carry through, and ultimately the prospects for success. In its simplest...

) of the idea. In some cases, there is some sort of prototype of the idea/product that is not fully developed or tested.

If the idea is not feasible at this stage, and the investor does not see any potential in the idea/product, the investor will not consider financing the idea. However if the idea/product is not directly feasible, but part of the idea is worth for more investigation, the investor may invest some time and money in it for further investigation.

Example:

A Dutch venture named High 5 Business Solution V.O.F. wants to develop a portal which allows companies to order lunch. To open this portal, the venture needs some financial resources, they also need marketeers and market researchers to investigate whether there is a market for their idea. To attract these financial and non-financial resources, the executives of the venture decide to approach ABN AMRO Bank to see if the bank is interested in their idea.

After a few meetings, the executives are successful in convincing the bank to take a look in the feasibility of the idea. ABN AMRO decides to put a few experts for investigation. After two weeks time, the bank decides to invest. They come to an agreement of invest a small amount of money into the venture. The bank also decides to provide a small team of marketeers and market researchers and a supervisor. This is done to help the venture with the realization of their idea and to monitor the activities in the venture.

Risk

At this stage, the risk of losing the investment is tremendously high, because there are so many uncertain factors. From research, we know that the risk of losing the investment for the VC-firm is around the 66.2% and the causation of major risk by stage of development is 72%. These percentages are based on the research done by Ruhnka, J.C. and Young, J.E.

The Start-up Stage

Business plan

A business plan is a formal statement of a set of business goals, the reasons why they are believed attainable, and the plan for reaching those goals. It may also contain background information about the organization or team attempting to reach those goals....

is presented by the attendant of the venture to the VC-firm. A management team is being formed to run the venture. If the company has a board of directors, a person from the VC-firms will take seats at the board of directors.

While the organisation is being set up, the idea/product gets its form. The prototype is being developed and fully tested. In some cases, clients are being attracted for initial sales. The management-team establishes a feasible production line to produce the product. The VC-firm monitors the feasibility of the product and the capability of the management-team from the Board of directors

Board of directors

A board of directors is a body of elected or appointed members who jointly oversee the activities of a company or organization. Other names include board of governors, board of managers, board of regents, board of trustees, and board of visitors...

.

To prove that the assumptions of the investors are correct about the investment, the VC-firm wants to see result of market research

Market research

Market research is any organized effort to gather information about markets or customers. It is a very important component of business strategy...

to see whether the market size is big enough, if there are enough consumers to buy their product. They also want to create a realistic forecast of the investment needed to push the venture into the next stage. If at this stage, the VC-firm is not satisfied about the progress or result from market research, the VC-firm may stop their funding and the venture will have to search for another investor(s). When the cause relies on handling of the management in charge, they will recommend replacing (parts of) the management team.

Example

Now the venture has attracted an investor, the venture need to satisfy the investor for further investment. To do that, the venture needs to provide the investor a clear business plan how to realise their idea and how the venture is planning to earn back the investment that is put into the venture, of course with a lucrative return.

Together with the market researchers, provided by the investor, the venture has to determine how big the market is in their region. They have to find out who are the potential clients and if the market is big enough to realise the idea.

From market research, the venture comes to know that there are enough potential clients for their portal site. But there are no providers of lunches yet. To convince these providers, the venture decided to do interviews with providers and try to convince them to join.

With this knowledge, the venture can finish their business plan and determine a pretty good forecast of the revenue, the cost of developing and maintaining the site and the profit the venture will earn in the following five years.

After reading the business plan and consulting the person who monitors the venture activities, the investor decides that the idea is worth for further development.

Risk

At this stage, the risk of losing the investment is shrinking, because the uncertainty is becoming clearer. The risk of losing the investment for the VC-firm is dropped to 53.0%, but the causation of major risk by stage of development becomes higher, which is 75.8%. This can be explained by the fact because the prototype was not fully developed and tested at the seed stage. And the VC-firm has underestimated the risk involved. Or it could be that the product and the purpose of the product have been changed during the development.

The Second Stage

Production, costs, and pricing

The following outline is provided as an overview of and topical guide to industrial organization:Industrial organization – describes the behavior of firms in the marketplace with regard to production, pricing, employment and other decisions...

. The venture is trying to minimize their losses in order to reach the break-even

Break-even

Break-even is a point where any difference between plus or minus or equivalent changes side.-In economics:A technique for which identifying the point where the total revenue is just sufficient to cover the total cost...

.

The management-team has to handle very decisively. The VC-firm monitors the management capability of the team. This consists of how the management-team manages the development process of the product and how they react to competition.

If at this stage the management-team is proven their capability of standing hold against the competition, the VC-firm will probably give a go for the next stage. However, if the management team lacks in managing the company or does not succeed in competing with the competitors, the VC-firm may suggest for restructuring of the management team and extend the stage by redoing the stage again. In case the venture is doing tremendously bad whether it is caused by the management team or from competition, the venture will cut the funding.

Example

The portal site needs to be developed. (If possible, the development should be taken place in house. If not, the venture needs to find a reliable designer to develop the site.) Developing the site in house is not possible; the venture does not have this knowledge in house. The venture decides to consult this with the investor. After a few meetings, the investor decides to provide the venture a small team of web-designers. The investor also has given the venture a deadline when the portal should be operational. The deadline is in 3 months.

In the meantime, the venture needs to produce a client-portfolio, who will provide their menu at the launch of the portal site. The venture also needs to come to an agreement how these providers are being promoted at the portal site and against what price.

After 3 months, the investor requests the status of development. Unfortunately for the venture, the development did not go as planned. The venture did not make the deadline. According to the one who is monitoring the activities, this is caused by the lack of decisiveness by the venture and the lack of skills of the designers.

The investor decides to cut back their financial investment after a long meeting. The venture is given another 3 months to come up with an operational portal site. Three designers are being replaced by a new designer and a consultant is attracted to support the executives’ decisions. If the venture does not make this deadline in time, they have to find another investor.

Luckily for the venture, with the come of the new designer and the consultant, the venture succeeds in making the deadline. They even have 2 weeks left before the second deadline ends.

Risk

At this stage, the risk of losing the investment still drops, because the venture is capable to estimate the risk. The risk of losing the investment for the VC-firm drops from 53.0% to 33.7%, and the causation of major risk by stage of development also drops at this stage, from 75.8% to 53.0%. This can be explained by the fact that there is not much developing going on at this stage. The venture is concentrated in promoting and selling the product. That is why the risk decreases.

The Third Stage

SWOT

SWOT may refer to:* Surface Water Ocean Topography Mission, a proposed NASA mission to make the first global survey of Earth’s surface water* SWOT analysis, a strategic planning method used to evaluate the Strengths, Weaknesses, Opportunities, and Threats involved in a project or business venture,...

analysis. It is used to figure out the strength, weakness, opportunity and the threat the venture is facing and how to deal with it.

Except that the venture is expanding, the venture also starts to investigate follow-up products and services. In some cases, the venture also investigates how to expand the life-cycle

Product life cycle management

Product life-cycle management is the succession of strategies used by business management as a product goes through its life-cycle. The conditions in which a product is sold changes over time and must be managed as it moves through its succession of stages.Product life-cycle Like human beings,...

of the existing product/service.

At this stage the VC-firm monitors the objectives already mentioned in the second stage and also the new objective mentioned at this stage. The VC-firm will evaluate if the management-team has made the expected reduction cost. They also want to know how the venture competes against the competitors. The new developed follow-up product will be evaluated to see if there is any potential.

Example

Finally the portal site is operational. The portal is getting more orders from the working class every day. To keep this going, the venture needs to promote their portal site. The venture decides to advertise by distributing flyers at each office in their region to attract new clients.

In the meanwhile, a small team is being assembled for sales, which will be responsible for getting new lunchrooms/bakeries, any eating-places in other cities/region to join the portal site. This way the venture also works on expanding their market.

Because of the delay at the previous stage, the venture did not fulfil the expected target. From a new forecast, requested by the investor, the venture expects to fulfil the target in the next quarter or the next half year. This is caused by external issues the venture does not have control of it. The venture has already suggested to stabilise the existing market the venture already owns and to decrease the promotion by 20% of what the venture is spending at the moment. This is approved by the investor.

Risk

At this stage, the risk of losing the investment for the VC-firm drops with 13.6% to 20.1%, and the causation of major risk by stage of development drops almost by half from 53.0% to 37.0%. However at this stage it happens often that new follow-up products are being developed. The risk of losing the investment is still decreasing. This may because the venture rely its income on the existing product. That is why the percentage continuous drop.

The Bridge/Pre-public Stage

- Hostile take over

- Merger with other companies;

- Keeping away new competitors from approaching the market;

- Eliminate competitors.

Internally, the venture has to reposition

Positioning (marketing)

In marketing, positioning has come to mean the process by which marketers try to create an image or identity in the minds of their target market for its product, brand, or organization....

the product and see where the product is positioned and if it is possible to attract new Market segmentation. This is also the phase to introduce the follow-up product/services to attract new clients and markets.

As we already mentioned, this is the final stage of the process. But most of the time, there will be an additional continuation stage involved between the third stage and the Bridge/pre-public stage. However there are limited circumstances known where investors made a very successful initial market impact might be able to move from the third stage directly to the exit stage. Most of the time the venture fails to achieves some of the important benchmarks the VC-firms aimed.

Example

Now the site is running smoothly, the venture is thinking about taking over the competitors’ website happen.nl. The site is promoting restaurants and is also doing business in online ordering food. This proposal is being protested by the investor, because it may cost a lot of the ventures’ capital. The investor suggests a merge instead.

To settle down their differences, the venture requested an external party to investigate into the case. The result of the investigation was a take-over. After reading the investigation, the investor agrees to it and happen.nl is being taken over by the venture. With the take-over of a competitor, the venture has expanded its services.

Seeing the ventures’ result, the investor comes to the conclusion that the venture still have not reach the target that was expected, but seeing how the business is progressing, the investor decides to extend its investment for another year.

Risk

At this final stage, the risk of losing the investment still exists. However, compared with the numbers mentioned at the seed-stage it is far lower. The risk of losing the investment the final stage is a little higher at 20.9%. This is caused by the number of times the VC-firms may want to expand the financing cycle, not to mention that the VC-firm is faced with the dilemma of whether to continuously invest or not. The causation of major risk by this stage of development is 33%. This is caused by the follow-up product that is introduced.

At Last

As mentioned in the first paragraph, a VC-firm is not only about funding and lucrative returns, but it offers also the non-funding issues like knowledge as well as for internal as for external issues. Also what we see here the further the process goes, the less risk of losing investment the VC-firm is risking.| Stage at which investment made | Risk of loss | Causation of major risk by stage of development |

| The Seed-stage | 66.2% | 72.0% |

| The Start-up Stage | 53.0% | 75.8% |

| The Second Stage | 33.7% | 53.0% |

| The Third Stage | 20.1% | 37.0% |

| The Bridge/Pre-public Stage | 20.9% | 33.0% |

See also

- Market researchMarket researchMarket research is any organized effort to gather information about markets or customers. It is a very important component of business strategy...

- Market segmentation

- PricingPricingPricing is the process of determining what a company will receive in exchange for its products. Pricing factors are manufacturing cost, market place, competition, market condition, and quality of product. Pricing is also a key variable in microeconomic price allocation theory. Pricing is a...

- SWORD-financingSWORD-financingSWORD-financing is a special form of financing invented to help young biotech companies access capital to finance their R&D via establishing SPE ....

- Corporate Venture CapitalCorporate Venture CapitalFrom September 2007 to April 2009, the financial services industry dominated the headlines and had a disproportionate impact on the world we live in. Given the profound effect that the financial services industry has on all areas of the global economy, it is important to understand this industry...

- Venture CapitalVenture capitalVenture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

Further reading

- Ruhnka, J.C., Young, J.E. (1987). "A venture capital model of the development process for new ventures". In: Journal of business venturing. Volume: 2, Issue: 2 (Spring 1987), pp: 167-184

- Ruhnka, Tyzoon T. Tyebjee, Albert V. Bruno (1984). "A Model of Venture Capitalist Investment Activity". In: Management science. Volume: 30, Issue: 9 (September 1984), pp: 1051-1066

- Frederick D. Lipman (1998). "Financing Your Business with Venture Capital: Strategies to Grow Your Enterprise with Outside Investors". In: Prima Lifestyles; 1st edition (November 15, 1998)