Unit Valuation System

Encyclopedia

The Unit Valuation System (UVS) was developed by Mutual Fund

s and Unit Trusts, as a means of determining fund performance in an environment where there are frequent cash contributions and withdrawals. The UVS is commonly used by Investment Clubs to apportion ownership between Investment Club

members, however it can also be used by individual investors as a time weighted return metric. UVS is now commonly used by Investment Clubs as it enables club members to make flexible monthly contributions (subscriptions) and withdrawals through the process of purchasing and cancelling units.

When comparing performance Money Weighted metrics, it is recommended that you use Internal Rate of Return calculations.

Investment Club member subscriptions (or from an individual perspective, 'deposits') are used to 'buy units' based on the current unit value and if a club member wants to make a withdrawal, they then 'sell units' typically through a process referred to as 'unit cancellation' based on the current unit value. Unit Cancellation can also be applied to trading expenses such as subscriptions to real time data or charting packages, in order for the Unit Value to only reflect trading performance.

Consider an Investment Club with 10 member, who normally contribute £100 in monthly subscriptions to their Investment Club fund. We are going to focus on one member of the club called 'Joe Bloggs'. If you take a look at the following table it provides an overview of the club's performance over time:

For the first 5 months, each club member contributes and equal amount of money and as the club performance increases and decrease, the unit value changes accordingly.

At the start of the first month, each member contributed £100, which is a total subscription of £1,000. The starting unit value was set to £1 by the club members, therefore the number of units allocated to each member was 100 (i.e. each club members monthly subscription divided by the unit value). The club then invested the £1,000 and the end of the first month made a return on investment of £250, therefore increasing the club Net Asset Value to £1,250. At the end of the first month the unit value has now increased because the Net Asset Value has increased. The resulting Unit Value is increased from £1 to £1.25 (i.e. the end of month Net Asset Value divided by the number of allocated units = £1,250 / 1,000 = £1.25).

At the start of the second month, each of the club members contribute a further £100 each, which increases the Net Asset Value by £1,000. This time they receive less unit for their £100 contribution as the unit value has increased from £1 to £1.25. The number of units that they get for their monthly subscription of £100 is 80 units, which is determined by dividing the subscription contribution by the unit value i.e. £100 / £1.25 = 80 units.

In the third, fourth and fifth month each club member continues to contribute £100 per month and the number of units that get is based on the previous ending monthly Unit Value.

At the start of the sixth month, Joe Bloggs decides to withdraw £100 from the investment club when the unit value is £1.70. To do so he 'sells' units back to the club, who in turn cancel the units. To withdraw £100 Joe Bloggs must sell approximately 59 units at a price of £1.70 per unit. As the Net Asset Value is reduced by £100 and the number of allocated units is reduced by 59 units due to the process of unit cancellation, with the result being that the unit value remains consistent at £1.70 (i.e. the ending Net Asset Value in month 5 is reduced £100 from £6,250 to £6,150 and the number of units are reduced by 59 due to member withdrawal of £100 therefore reducing the total number of units from 3,670 to 3,611; the resulting unit value is then unchanged because £6,250/3,670 units = £6,150/3,611 units = £1.70)

The exclusion of none tax deductible expenses ensure that the Unit Value calculations are only based on investment performance. Unit Value is determined by the total assets divided by the number of units allocated. If you deduct a none trading expense from the total assets, without changing the number of allocated units, then the unit value will be reduced. This would have the side effect of making the investment performance appear to have decreased - whereas you may have simply elected to use funds for some common purpose, such as an annual meal.

To ensure that unit value remains consistent after a withdrawal or after the payment of an expenses, a commonly used solution to this problem is to cancel a number of allocated units, such that the number of allocated units is reduced in line with the reduced value of the club assets. The net effect being that the Unit Value remains constant.

If you do not want to include income or expenditures transactions in the calculation of the unit value you can either:

Given the complexity of these calcuations most investment clubs use investment club accounting software.

When using unit cancellation on a transaction, the transaction is ignored for the purposes of calculating the Unit Value, but still considered when calculating the club's total assets. As the assets and Unit Value remain unchanged after a transaction is exclude through the process of unit cancellation, the number of units can therefore be derived. This has the effect of removing (or cancelling) a number of units from the club's accounts. Each member's units are therefore decreased by an equal amount during unit cancellation.

Mutual fund

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors to buy stocks, bonds, short-term money market instruments, and/or other securities.- Overview :...

s and Unit Trusts, as a means of determining fund performance in an environment where there are frequent cash contributions and withdrawals. The UVS is commonly used by Investment Clubs to apportion ownership between Investment Club

Investment club

An investment club is a group of individuals who meet on a regular basis for the purpose of pooling money and retail investing. The invested sums can be $30 to $100 per month. For certain type of club pooling money is not mandatory...

members, however it can also be used by individual investors as a time weighted return metric. UVS is now commonly used by Investment Clubs as it enables club members to make flexible monthly contributions (subscriptions) and withdrawals through the process of purchasing and cancelling units.

Purpose

UVS is a time weighted performance metric that is used by Investment Clubs to apportion ownership between Investment Club members. It enables club members to make flexible monthly contributions (subscriptions) and withdrawals through the process of purchasing and cancelling units. As a performance metric the Unit Valuation System strength lies in the ability to apportion ownership at any point in time, as club members buy and sell units through making subscriptions and withdrawals. It is an effective means of reflecting changes between day to day investment performance, however it should not be used as a metric for comparing investment performance between for example two Investment Clubs.When comparing performance Money Weighted metrics, it is recommended that you use Internal Rate of Return calculations.

Implementation

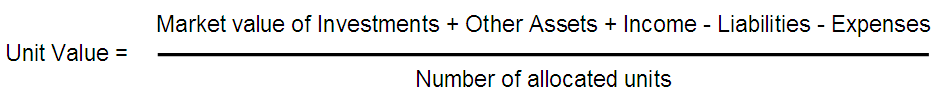

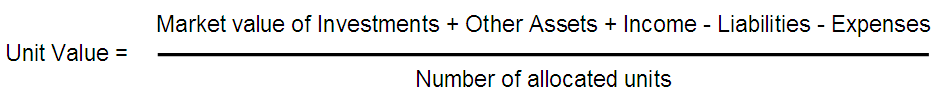

The equation for calculating Unit Value is based on net assets (which are included in the UVS calculations) divided by the number of allocated units:

Investment Club member subscriptions (or from an individual perspective, 'deposits') are used to 'buy units' based on the current unit value and if a club member wants to make a withdrawal, they then 'sell units' typically through a process referred to as 'unit cancellation' based on the current unit value. Unit Cancellation can also be applied to trading expenses such as subscriptions to real time data or charting packages, in order for the Unit Value to only reflect trading performance.

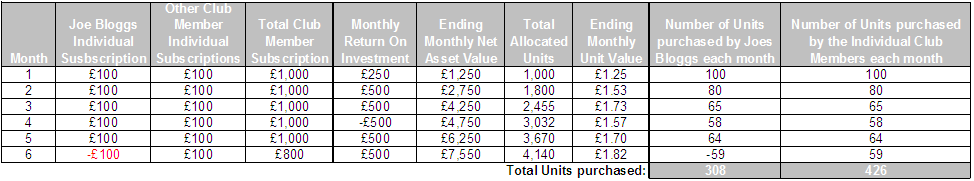

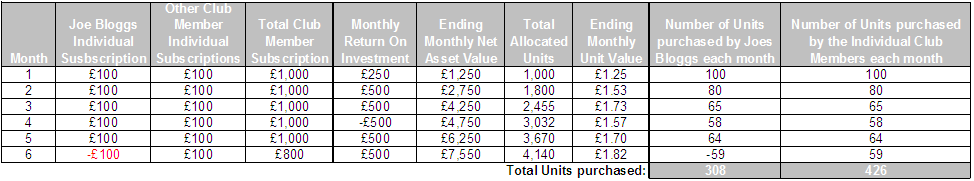

Consider an Investment Club with 10 member, who normally contribute £100 in monthly subscriptions to their Investment Club fund. We are going to focus on one member of the club called 'Joe Bloggs'. If you take a look at the following table it provides an overview of the club's performance over time:

For the first 5 months, each club member contributes and equal amount of money and as the club performance increases and decrease, the unit value changes accordingly.

At the start of the first month, each member contributed £100, which is a total subscription of £1,000. The starting unit value was set to £1 by the club members, therefore the number of units allocated to each member was 100 (i.e. each club members monthly subscription divided by the unit value). The club then invested the £1,000 and the end of the first month made a return on investment of £250, therefore increasing the club Net Asset Value to £1,250. At the end of the first month the unit value has now increased because the Net Asset Value has increased. The resulting Unit Value is increased from £1 to £1.25 (i.e. the end of month Net Asset Value divided by the number of allocated units = £1,250 / 1,000 = £1.25).

At the start of the second month, each of the club members contribute a further £100 each, which increases the Net Asset Value by £1,000. This time they receive less unit for their £100 contribution as the unit value has increased from £1 to £1.25. The number of units that they get for their monthly subscription of £100 is 80 units, which is determined by dividing the subscription contribution by the unit value i.e. £100 / £1.25 = 80 units.

In the third, fourth and fifth month each club member continues to contribute £100 per month and the number of units that get is based on the previous ending monthly Unit Value.

At the start of the sixth month, Joe Bloggs decides to withdraw £100 from the investment club when the unit value is £1.70. To do so he 'sells' units back to the club, who in turn cancel the units. To withdraw £100 Joe Bloggs must sell approximately 59 units at a price of £1.70 per unit. As the Net Asset Value is reduced by £100 and the number of allocated units is reduced by 59 units due to the process of unit cancellation, with the result being that the unit value remains consistent at £1.70 (i.e. the ending Net Asset Value in month 5 is reduced £100 from £6,250 to £6,150 and the number of units are reduced by 59 due to member withdrawal of £100 therefore reducing the total number of units from 3,670 to 3,611; the resulting unit value is then unchanged because £6,250/3,670 units = £6,150/3,611 units = £1.70)

Unit Cancellation

Unit Cancellation is typically used for withdrawals and when you want to exclude none tax deductible expenses from Unit Value calculations.The exclusion of none tax deductible expenses ensure that the Unit Value calculations are only based on investment performance. Unit Value is determined by the total assets divided by the number of units allocated. If you deduct a none trading expense from the total assets, without changing the number of allocated units, then the unit value will be reduced. This would have the side effect of making the investment performance appear to have decreased - whereas you may have simply elected to use funds for some common purpose, such as an annual meal.

To ensure that unit value remains consistent after a withdrawal or after the payment of an expenses, a commonly used solution to this problem is to cancel a number of allocated units, such that the number of allocated units is reduced in line with the reduced value of the club assets. The net effect being that the Unit Value remains constant.

If you do not want to include income or expenditures transactions in the calculation of the unit value you can either:

- set up a separate Ledger that is not included in the UVS calculations, such as a Petty Cash Ledger

- or you can exclude specific income or expenditure transactions from a Ledger that is included in the Unit Value calculations

Given the complexity of these calcuations most investment clubs use investment club accounting software.

When using unit cancellation on a transaction, the transaction is ignored for the purposes of calculating the Unit Value, but still considered when calculating the club's total assets. As the assets and Unit Value remain unchanged after a transaction is exclude through the process of unit cancellation, the number of units can therefore be derived. This has the effect of removing (or cancelling) a number of units from the club's accounts. Each member's units are therefore decreased by an equal amount during unit cancellation.