Total return swap

Encyclopedia

Contract

A contract is an agreement entered into by two parties or more with the intention of creating a legal obligation, which may have elements in writing. Contracts can be made orally. The remedy for breach of contract can be "damages" or compensation of money. In equity, the remedy can be specific...

that transfers both the credit risk

Credit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

and market risk

Market risk

Market risk is the risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. The four standard market risk factors are stock prices, interest rates, foreign exchange rates, and commodity prices...

of an underlying asset.

Contract definition

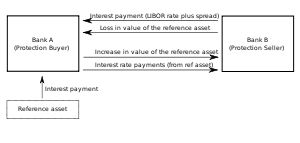

Let us assume that one bank (bank A) owns an asset (e.g. a bond) that periodically gives interest rate payments. Assume that bank A (the protection buyer) and bank B (the protection seller) have entered a total return swap contract. According to this contract, bank A is paying all interest payments on the reference asset, plus any capital gains (positive price changes of the asset) over the payment period to bank B. Furthermore, bank B is paying LIBOR plus a spread as well as any negative price changes of the asset. In case of a default of the underlying asset, the asset is valued to zero and bank B has to pay the full initial market price of the asset (which was valid at the start of the contract).The reference asset may be any asset, index, or basket of assets. TRORS are particularly popular on bank loans, which do not have a liquid repo

Repurchase agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is the sale of securities together with an agreement for the seller to buy back the securities at a later date. The repurchase price should be greater than the original sale price, the difference effectively...

market.

Advantage of using Total Rate Swaps

The TRORS allows one party (bank B) to derive the economic benefit of owning an asset without putting that asset on its balance sheetBalance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A...

, and allows the other (bank A, which does retain that asset on its balance sheet) to buy protection against loss in its value.

TRORS can be categorised as a type of credit derivative

Credit derivative

In finance, a credit derivative is a securitized derivative whose value is derived from the credit risk on an underlying bond, loan or any other financial asset. In this way, the credit risk is on an entity other than the counterparties to the transaction itself...

, although the product combines both market risk

Market risk

Market risk is the risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. The four standard market risk factors are stock prices, interest rates, foreign exchange rates, and commodity prices...

and credit risk

Credit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

, and so is not a pure credit derivative

Credit derivative

In finance, a credit derivative is a securitized derivative whose value is derived from the credit risk on an underlying bond, loan or any other financial asset. In this way, the credit risk is on an entity other than the counterparties to the transaction itself...

.

Users

Hedge funds are using Total Return Swaps to obtain leverage on the Reference Assets: they can receive the return of the asset, typically from a bank (which has a funding cost advantage), without having to put out the cash to buy the Asset. They usually post a smaller amount of collateral upfront, thus obtaining leverage.Hedge funds (such as The Children's Investment Fund (TCI)) have attempted to use Total Return Swaps to side-step public disclosure requirements enacted under the Williams Act

Williams Act

The Williams Act refers to amendments to the Securities Exchange Act of 1934 enacted in 1968 regarding tender offers. The legislation was proposed by Senator Harrison A. Williams of New Jersey....

. As discussed in CSX Corp. v. The Children's Investment Fund Management, TCI argued that it was not the beneficial owner of the shares referenced by its Total Return Swaps and therefore the swaps did not require TCI to publicly disclose that it had acquired a stake of more than 5% in CSX. The United States District Court rejected this argument and enjoined TCI from further violations of Section 13(d) Securities Exchange Act and the SEC-Rule promulgated thereunder.

Total Return Swaps are also very common in many structured finance transactions such as Collateralized Debt Obligations (CDO

CDO

CDO may refer to:* Cagayan de Oro, a city that lies along the northern coastline of Mindanao island, Philippines.* Canyon del Oro High School, a public school in Oro Valley, Arizona, USA....

s). CDO Issuers often enter TRS agreements as protection seller in order to leverage the returns for the structure's debt investors. By selling protection, the CDO gains exposure to the underlying asset(s) without having to put up capital to purchase the assets outright. The CDO gains the interest receivable on the reference asset(s) over the period while the counterparty mitigates their market of risk.