Prime rate

Encyclopedia

Prime rate or prime lending rate is a term applied in many countries to a reference interest rate

used by banks. The term originally indicated the rate of interest at which banks lent to favored customers, i.e., those with high credibility, though this is no longer always the case. Some variable interest rates may be expressed as a percentage above or below prime rate.

, and the Canadian prime rate is currently 3.00%.

In the U.S., the prime rate runs approximately 300 basis point

s (or 3 percentage points) above the federal funds rate

, the interest rate that banks charge to each other for overnight loans made to fulfill reserve funding requirements: (federal funds rate) + (3 %) = (prime rate). The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy borrowers today, as is LIBOR, the London Interbank Offered Rate

. The Federal Open Market Committee

(FOMC) meets eight times per year wherein they set a target for the federal funds rate. Other rates, including the prime rate, derive from this base rate.

Prior to December 17, 2008, when 23 out of 30 of the United States' largest banks changed their prime rate, the Wall Street Journal would change its published rate. On December 17, 2008, the Wall Street Journal recognized that fewer, but larger banks controlled most assets and changed the methodology for the prime rate that is published. The Journal's rate today now reflects the base rate posted by at least 70% of the top ten banks by assets.

s and home equity lines of credit with variable interest rates have their rate specified as the prime rate (index) plus a fixed value commonly called the spread or margin.

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

used by banks. The term originally indicated the rate of interest at which banks lent to favored customers, i.e., those with high credibility, though this is no longer always the case. Some variable interest rates may be expressed as a percentage above or below prime rate.

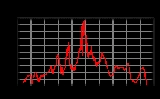

United States and Canada

Historically, in North American banking, the prime rate was the actual interest rate although this is no longer the case. The prime rate varies little among banks, and adjustments are generally made by banks at the same time, although this does not happen with frequency. The prime rate is currently 3.25% in the United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, and the Canadian prime rate is currently 3.00%.

In the U.S., the prime rate runs approximately 300 basis point

Basis point

A basis point is a unit equal to 1/100 of a percentage point or one part per ten thousand...

s (or 3 percentage points) above the federal funds rate

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis. Institutions with surplus balances in their accounts lend...

, the interest rate that banks charge to each other for overnight loans made to fulfill reserve funding requirements: (federal funds rate) + (3 %) = (prime rate). The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy borrowers today, as is LIBOR, the London Interbank Offered Rate

London Interbank Offered Rate

The LIBOR rate is the average interest rate that leading banks in London charge when lending to other banks. It is an acronym for London Interbank Offered Rate Banks borrow money for one day, one month, two months, six months, one year etc. and they pay interest to their lenders based on...

. The Federal Open Market Committee

Federal Open Market Committee

The Federal Open Market Committee , a committee within the Federal Reserve System, is charged under United States law with overseeing the nation's open market operations . It is the Federal Reserve committee that makes key decisions about interest rates and the growth of the United States money...

(FOMC) meets eight times per year wherein they set a target for the federal funds rate. Other rates, including the prime rate, derive from this base rate.

Prior to December 17, 2008, when 23 out of 30 of the United States' largest banks changed their prime rate, the Wall Street Journal would change its published rate. On December 17, 2008, the Wall Street Journal recognized that fewer, but larger banks controlled most assets and changed the methodology for the prime rate that is published. The Journal's rate today now reflects the base rate posted by at least 70% of the top ten banks by assets.

Uses

The prime rate is used often as an index in calculating rate changes to adjustable rate mortgages (ARM) and other variable rate short term loans. It is used in the calculation of some private student loans. Many credit cardCredit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

s and home equity lines of credit with variable interest rates have their rate specified as the prime rate (index) plus a fixed value commonly called the spread or margin.