Financial distress

Encyclopedia

Financial distress is a term in Corporate Finance

used to indicate a condition when promises to creditors of a company are broken or honored with difficulty. Sometimes financial distress can lead to bankruptcy

. Financial distress is usually associated with some costs to the company; these are known as costs of financial distress.

Financial distress in companies can lead to problems that can reduce the efficiency of management. As maximizing firm value and maximizing shareholder value

Financial distress in companies can lead to problems that can reduce the efficiency of management. As maximizing firm value and maximizing shareholder value

cease to be equivalent managers who are responsible to shareholders might try to transfer value from creditors to shareholders.

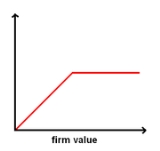

The result is a conflict of interest between bondholders (creditors) and shareholders. As a firm's liquidation value slips below its debt, it is the shareholder's interest for the company to invest in risky projects which increase the probability of the firm's value to rise over debt. Risky projects are not in the interest of creditors, since they also increase the probability of the firms value to decrease further, leaving them with even less. Since these projects do not necessarily have a positive net present value

The result is a conflict of interest between bondholders (creditors) and shareholders. As a firm's liquidation value slips below its debt, it is the shareholder's interest for the company to invest in risky projects which increase the probability of the firm's value to rise over debt. Risky projects are not in the interest of creditors, since they also increase the probability of the firms value to decrease further, leaving them with even less. Since these projects do not necessarily have a positive net present value

, costs may arise from lost profits

.

Equally, management might choose to prolong bankruptcy, which has the same effect on probabilities of a change in the firm's value. Management might also distribute high dividends to "save" money from the creditors.

Another source of indirect costs of financial distress are higher costs of capital: Short-term loans by contractors and banks are expensive and difficult to obtain.

where valuations are used as negotiating tools. This distinction between negotiation and process is a difference between financial restructuring and corporate finance

.

Additional modifications to a valuation approach, whether it is market-, income- or asset-based, may be necessary in some instances. There are other adjustments to the financial statements that have to be made when valuing a distressed company.

is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress, to reduce and renegotiate its delinquent debts in order to improve or restore liquidity

and rehabilitate so that it can continue its operations.

If promises to creditors cannot be kept, bankruptcy

is an option for both companies and individuals. In the United Kingdom

, the Individual Voluntary Arrangement

is a formal alternative to bancruptcy for individuals.

Corporate finance

Corporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make these decisions. The primary goal of corporate finance is to maximize shareholder value while managing the firm's financial risks...

used to indicate a condition when promises to creditors of a company are broken or honored with difficulty. Sometimes financial distress can lead to bankruptcy

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

. Financial distress is usually associated with some costs to the company; these are known as costs of financial distress.

Cost of financial distress

A common example of a cost of financial distress is bankruptcy costs. These direct costs include auditors' fees, legal fees, management fees and other payments. Cost of financial distress can occur even if bankruptcy is avoided (indirect costs):

Shareholder value

Shareholder value is a business term, sometimes phrased as shareholder value maximization or as the shareholder value model, which implies that the ultimate measure of a company's success is the extent to which it enriches shareholders...

cease to be equivalent managers who are responsible to shareholders might try to transfer value from creditors to shareholders.

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

, costs may arise from lost profits

Opportunity cost

Opportunity cost is the cost of any activity measured in terms of the value of the best alternative that is not chosen . It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices. The opportunity cost is also the...

.

Equally, management might choose to prolong bankruptcy, which has the same effect on probabilities of a change in the firm's value. Management might also distribute high dividends to "save" money from the creditors.

Another source of indirect costs of financial distress are higher costs of capital: Short-term loans by contractors and banks are expensive and difficult to obtain.

Valuation

Companies in financial distress undergo corporate restructuringRestructuring

Restructuring is the corporate management term for the act of reorganizing the legal, ownership, operational, or other structures of a company for the purpose of making it more profitable, or better organized for its present needs...

where valuations are used as negotiating tools. This distinction between negotiation and process is a difference between financial restructuring and corporate finance

Corporate finance

Corporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make these decisions. The primary goal of corporate finance is to maximize shareholder value while managing the firm's financial risks...

.

Additional modifications to a valuation approach, whether it is market-, income- or asset-based, may be necessary in some instances. There are other adjustments to the financial statements that have to be made when valuing a distressed company.

Options for Relieving Financial Distress

Debt restructuringDebt restructuring

Debt restructuring is a process that allows a private or public company – or a sovereign entity – facing cash flow problems and financial distress, to reduce and renegotiate its delinquent debts in order to improve or restore liquidity and rehabilitate so that it can continue its...

is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress, to reduce and renegotiate its delinquent debts in order to improve or restore liquidity

Accounting liquidity

In accounting, liquidity is a measure of the ability of a debtor to pay his debts as and when they fall due. It is usually expressed as a ratio or a percentage of current liabilities.-Calculating liquidity:...

and rehabilitate so that it can continue its operations.

If promises to creditors cannot be kept, bankruptcy

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

is an option for both companies and individuals. In the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

, the Individual Voluntary Arrangement

Individual Voluntary Arrangement

In the UK, an Individual Voluntary Arrangement is a formal alternative for individuals wishing to avoid bankruptcy.The IVA was established by and is governed by Part VIII of the Insolvency Act 1986 and constitutes a formal repayment proposal presented to a debtor's creditors via an Insolvency...

is a formal alternative to bancruptcy for individuals.

External links

- Indicators and Sources of Financial Distress

- Predicting Financial Distress of Companies: Revisiting the Z-Score and Zeta Models by Edward Altman

- Financial Distress, Bankruptcy Law, and the Business Cycle by Javier Suarez and Oren Sussman

- Costs of Financial Distress across Industries by Arthur Korteweg

- Insolvency Service website

- Insolvency Service website