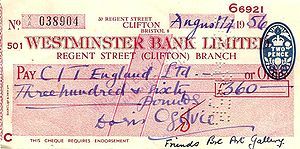

Any cheque crossed with two parallel lines means that the cheque can only be deposited directly into an account with a bank and cannot be immediately cashed by a bank over the counter. By using crossed cheques, cheque writers can effectively protect the cheques they write from being stolen and cashed. However, crossed cheques are rarely used in the U.S.

Crossing of cheques

Cheques can be of two types:-

1. Open or an uncrossed

chequeA cheque is a document/instrument See the negotiable cow—itself a fictional story—for discussions of cheques written on unusual surfaces. that orders a payment of money from a bank account...

2. Crossed cheque

Open Cheque

An open

chequeA cheque is a document/instrument See the negotiable cow—itself a fictional story—for discussions of cheques written on unusual surfaces. that orders a payment of money from a bank account...

is a cheque which is payable at the counter of the drawee

bankA bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

on presentation of the cheque.

Crossed Cheque

A crossed cheque is a cheque which is payable only through a collecting

bankA bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

er and not directly at the counter of the bank. Crossing ensures security to the holder of the cheque as only the collecting banker credits the proceeds to the account of the payee of the cheque.

When two parallel

transverseTransverse may refer to:*Transversality, a concept related to the intersection of manifolds in topology*Transverse City, an album by Warren Zevon...

lines, with or without any words, are drawn generally, on the left hand top corner of the cheque. A crossed cheque does not effect the negotiability of the instrument. It can be negotiated the same way as any other negotiable instrument.

Types of Crossing

There are two types of negotiable instruments:-

• General Crossing

• Special Crossing

• Account Payee or Restrictive Crossing

• 'Not Negotiable' Crossing

Cheque crossed specially

Where a cheque bears across its face an addition of the name of a banker, either with or without the words 'Not Negotiable', that addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially, and to be crossed to that banker.This is called special crossed cheque.

Account Payee or Restrictive Crossing

This crossing can be made in both general and special crossing by adding the words

Account Payee. In this type of crossing the collecting banker is supposed to credit the amount of the cheque to the account of the payee only. The cheque remains transferable but the liability of the collecting banker is enhanced in case he credits the proceeds of the cheque so crossed to any person other than the payee and the endorsement in favour of the last payee is proved forged. The collecting banker must act like a blood hound and make proper enquiries as to the title of the last endorsee from the original payee named in the cheque before collecting an 'Account Payee' cheque in his account. The same can be done by place slanted parallel line in the top most left corner of the cheque - in writing over their A/C payee's only.

Not Negotiable Crossing

The words 'Not Negotiable' can be added to General as well as Special crossing and a crossing with these words is known as

Not Negotiable crossing. The effect of such a crossing is that it removes the most important characteristic of a negotiable instrument i.e. the transferee of such a crossed cheque cannot get a better title than that of the transferor (cannot become a holder in due course) and cannot convey a better title to his own transferee, though the instrument remains transferable.

Consequence of a bank not complying with the crossing

A bank's failure to comply with the crossings amounts to a breach of contract with its customer. The bank may not be able to debit the drawer's account and may be liable to the true owner for his loss.

The source of this article is

wikipedia, the free encyclopedia. The text of this article is licensed under the

GFDL.