Bond of association

Encyclopedia

Credit union

A credit union is a cooperative financial institution that is owned and controlled by its members and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members...

s and co-operative banks

Cooperative banking

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world....

. Common bonds substitute for collateral

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.The collateral serves as protection for a lender against a borrower's default - that is, any borrower failing to pay the principal and interest under the terms of a loan obligation...

in the early stages of financial system

Financial system

In finance, the financial system is the system that allows the transfer of money between savers and borrowers. A financial system can operate on a global, regional or firm specific level...

development. Like solidarity lending

Solidarity lending

Solidarity lending is a lending practice where small groups borrow collectively and group members encourage one another to repay. It is an important building block of microfinance.-How it Works:...

, the common bond has since played an important role in facilitating the development of microfinance

Microfinance

Microfinance is the provision of financial services to low-income clients or solidarity lending groups including consumers and the self-employed, who traditionally lack access to banking and related services....

for poor people.

In modern financial systems, common bonds remain a key building block, especially for the strategic networks that underpin many of Europe’s co-operative banks.

How bonds work

Hermann Schulze-Delitzsch, an early co-operative organizer, explained the concept of the ‘bond of association’ at credit union meetings in this way:| ... your own selves and character must create your credit, and your collective liability will require you to choose your associates carefully, and to insist that they maintain regular, sober and industrious habits, making them worthy of credit. |

In his book People’s Banks (1910), Henry W. Wolff summarized the character of this ‘common bond’ based on his observations of credit unions all over Europe:

1. many individuals bring small amounts of share capital into a common pool, which collectively amounts to significant base of collateral,

2. borrowers, lenders and guarantors live near one another (e.g., in the same village), making it convenient for the lender and guarantors to monitor the performance of the borrower, and manage any problems that may come up,

3. an ‘inter-connection of liability among members’ is created by the bond, which may either involve direct and unlimited ‘financial liability’, or ‘direct responsibility for good management’ (which once publicly established increases the sense of security of claim-holders), and

4. all operations of the credit union must be conducted along ‘businesslike lines’ based on a strong sense of collective responsibility.

Diverse types of bonds

There are several distinct types of bonds, corresponding to distinctive types of credit unions. For example:- The RaiffeisenFriedrich Wilhelm RaiffeisenFriedrich Wilhelm Raiffeisen was a German mayor and cooperative pioneer. Several credit union systems and cooperative banks have been named after Raiffeisen, who pioneered rural credit unions.- Life :...

banks in Germany relied on parish-based bonds, as parishes were very small and people were in constant communication with each other through the central nexus of the local church. Similarly, the Caisses populaires of Quebec were originally "organized along the boundaries of Roman Catholic parishes".

- The bonds on the multi-ethnic Canadian Prairies were community-based, linking members through their common residency in small towns and villages.

- Common bonds in early United StatesUnited StatesThe United States of America is a federal constitutional republic comprising fifty states and a federal district...

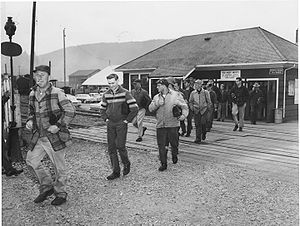

credit unions were generally employee-based, and concentrated in the manufacturing and transportation industries, and among teachers and postal workers.

Debate between Schulze-Delitzsch and Raiffeisen

A bitter debate between two German credit union pioneers over the nature of bonds of association eventually ended in a tie, with Schulz-Delitzsch’s approach dominating in urban settings, and Raiffeisen’s dominating in rural ones.The bond of association for Schulze’s larger, more urban ‘people’s banks’ required all members to contribute substantial share capital. He advocated that these banks should receive the protection of limited liability.

Friedrich Wilhelm Raiffeisen

Friedrich Wilhelm Raiffeisen

Friedrich Wilhelm Raiffeisen was a German mayor and cooperative pioneer. Several credit union systems and cooperative banks have been named after Raiffeisen, who pioneered rural credit unions.- Life :...

strongly opposed any share capital requirement. Arguing that most farmers had too little cash to afford share capital, he maintained that the principle of unlimited joint liability was “indispensable in small districts". It was needed "in order to prevent the Unions from excess, since it makes the administrative bodies conscious of their moral and material responsibilities.”

See also

- History of credit unions

- MicrofinanceMicrofinanceMicrofinance is the provision of financial services to low-income clients or solidarity lending groups including consumers and the self-employed, who traditionally lack access to banking and related services....

- NCUA v. First National Bank & TrustNCUA v. First National Bank & TrustNCUA v. First National Bank & Trust, , is a legal case in which the Supreme Court of the United States ruled that banks had prudential standing to challenge regulations that permitted credit unions to enroll unaffilated members.-Background:...